The European power market will see its carbon intensity plummet as the region pursues ambitious climate-energy policies, but flexibility is key to enable this change, according to Peter Osbaldstone, Research Director, Europe Power & Renewables at Wood Mackenzie.

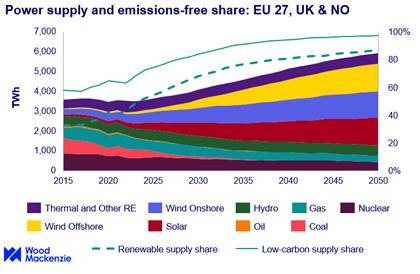

Speaking at the Enlit Europe event in Paris, Osbaldstone told delegates that emissions-free supply will climb from 65% today to 85% by 2030, with 67% of power from renewables, according to latest Wood Mackenzie analysis.

“The European market is dominated by wind and solar development and will therefore be subject to an increasingly variable supply mix,” Osbaldstone said. “This makes flexibility a critical enabler of accelerated change, in addition to efficient planning systems, infrastructure expansion, appropriate market function and the progress of electrification.”

“The current policy push to 2030, a steppingstone to 2050 net-zero aspirations, is driving a surge in activity over coming years. This presents challenges – we’ll see pressure on renewables integration and limitations in the supply chain, which will slow down the delivery of new capacity and affect overall delivery costs,” added Osbaldstone.

These challenges will influence the level of new capacity delivered in the late-2020s, activity will still be at record levels, but we’ll also see some project slippage into the early-2030s, according to Wood Mackenzie analysis.

Osbaldstone told delegates: “The market becomes more balanced in the long-term – where new supply meets new demand, and a sustainable rate of change is established. At this point, the pace and location of electrification will affect how much market space there is for new technologies, such as solar and wind capacity."

Technology attractiveness varies by market

The attractiveness of different renewable technology continues to vary by market. Market conditions must be matched with appropriate route-to-market choices, be those merchant operation, contractual support or out-of-market instruments, such as Contracts-for-Difference.

Osbaldstone commented: “Offshore wind is the most expensive technology that can be readily deployed in high volumes. The role of governments is central to wind’s expansion, policymakers must support industry stakeholders and projects by matching policy requirements to action. The right commercial arrangements and incentives will be essential.”

Market flexibility is key

Market prices will become increasingly volatile as power decarbonizes, according to Wood Mackenzie analysis. Despite average annual prices falling over time, significant hourly volatility will grow in all markets, which emphasizes the importance of flexible resources. With wind and solar driving supply growth, weather sensitivity becomes ever more important.

Osbaldstone stated: “As supply becomes more variable, markets must adapt if climate change policies are to be delivered. This adaption will including the use of battery storage, interconnection, and flexible thermal generators, among other technologies.”

“The industry also needs a much more engaged and dynamic demand side, embedding flexible behaviors into new and existing sectors. Consumers must be willing and equipped to react to price signals, such as time-of-day tariffs and more short-term demand flexibility services.”