Russian oil company Lukoil has decided not to launch a binding takeover offer for Australian oil firm FAR, which owns a share in the Sangomar field offshore Senegal.

FAR had in February received a conditional non-binding indicative proposal from Lukoil to acquire the shares of FAR at 2.2c cash per share, subject to FAR delaying a shareholders meeting to approve the previously agreed sale of its Sangomar field sale to Woodside.

FAR delayed the meeting, however, given that Lukoil was stalling with the firm offer, it said in March it would sell to Woodside.

In a statement on Thursday, FAR said it had received info from Lukoil that the Russian company wouldn't be making a firm offer.

"FAR had cautioned that the Lukoil Proposal was not a legally binding offer, was subject to targeted and timely corporate due diligence on FAR, was subject to final Lukoil board approval, and that there was no certainty that the Lukoil Proposal would necessarily eventuate," FAR said Wednesday.

"Accordingly, care needed to be used in assessing the Lukoil proposal. FAR has been advised by Lukoil that the Lukoil proposal is not proceeding to a legally binding offer," FAR said.

FAR has convened a shareholders meeting on April 15, 2021, to consider approving the sale of its interest in the Senegal RSSD project to Woodside.

"The FAR directors continue to support the Woodside sale," FAR said.

Worth noting, FAR in December 2020 received a non-binding A$209.6 million all-cash takeover proposal from private investment firm Remus Horizons PCC Ltd on the table, which was conditional on the Woodside sale not occurring. However, Remus also fell short of submitting a binding offer.

"If a takeover offer from Remus Horizons PCC Limited or any alterative offer emerges, the directors will update shareholders accordingly and may reconsider their recommendation," FAR said Thursday.

Lukoil had previously attempted to get into the Sangomar project, through an agreement to acquire an interest in the RSSD Project from Cairn Energy, which was subsequently pre-empted by Woodside.

Also, Far, which has struggled to come up with cash needed to support the Sangomar development, had in 2020 agreed to sell its stake to ONGC Videsh, only for the deal to be blocked by FAR's partner and the field operator Woodside, which matched ONGC Videsh's bid.

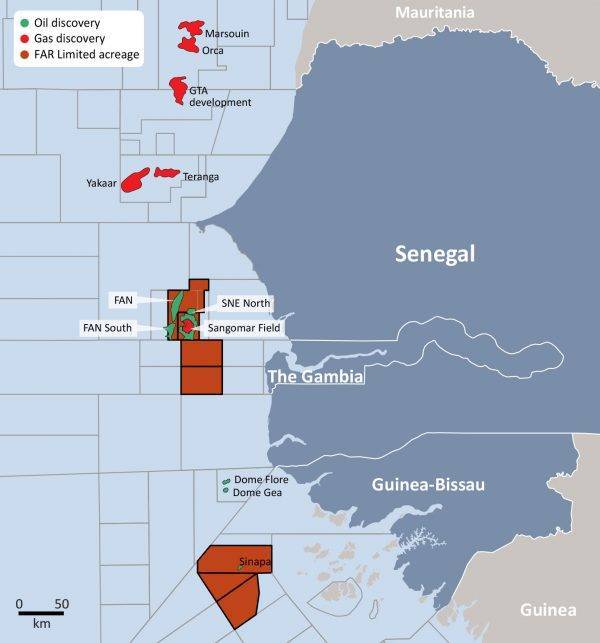

The Woodside-operated Sangomar field development was sanctioned in early 2020. The field will be developed using an FPSO to be delivered by MODEC. The FPSO will be deployed approximately 100 kilometers south of Dakar, Senegal, and will be Senegal's first offshore oil development.

The FPSO is scheduled for delivery to support the production of the first oil in 2023 and will be moored in approximately 780 meters water depth. The recoverable hydrocarbon reserves of the Sangomar field total approximately 500 million boe. Credit: FAR

Credit: FAR