Sval Energi has signed an agreement with Suncor Energy to acquire Suncor Energy Norge, adding 4000 barrels of oil equivalent and 19 million barrels of oil equivalent in reserves on the Norwegian Continental Shelf to its portfolio.

The deal is worth about $410 million Canadian dollars, gross, according to Suncor, and is expected to complete in Q4 this year, with an effective date of March 1, 2022.

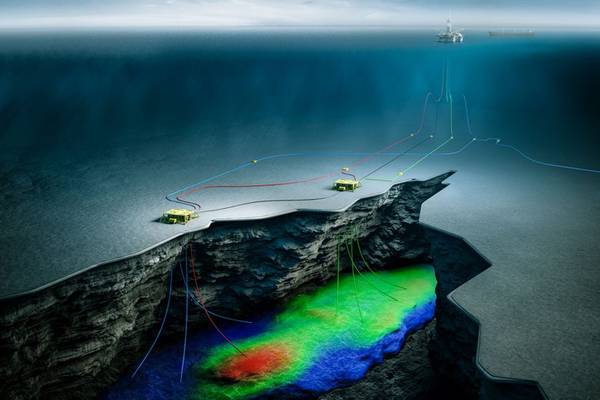

Sval Energi says deal includes 17.5% ownership in the Fenja field (PL 586), 30% ownership in the Oda field (PL 405) and eight additional licenses. Suncor Energy Norge staff will transfer to Sval Energi.

"The transaction will add a daily production of approximately 4000 barrels of oil equivalent and 19 million barrels of oil equivalent in reserves to the Sval Energi portfolio," said the company.

CEO Nikolai Lyngø of Sval Energi said: “This transaction represents another step on our growth journey. We already have a capable team in place and look forward to welcoming new colleagues from Suncor’s Norway team – they will strengthen us even further.

“The Norwegian Continental Shelf is still attractive, and we are building a strong cash-generating business in Norway with producing assets, future developments, and exciting exploration opportunities. We are executing our strategy and transforming into a significant player on the Norwegian Shelf.”

In June, Sval Energi completed the acquisition of Spirit Energy Norway from Centrica. The USD 1,026 million Spirit Energy Norway acquisition closed May 31, with January 1 2021 as the commercial effective date. The acquisition includes 45 licenses (6 operated), including 7 producing fields (2 operated), and several development and exploration opportunities.

Back in 2021, Sval completed the $300 million acquisition of Edison Norge. The deal, first announced in December 2020, saw HitecVision-backed Sval acquiring ten production licenses on the Norwegian continental shelf.

The assets included 10% ownership of the Dvalin field development and increased Sval Energy's Nova field development holding by 15% to a total of 25%. The assets brought Sval additional net reserves of around 25 million barrels of oil equivalent.