Oil and gas project sanctioning in 2020 could drop almost 70% compared to 2019 if the oil prices remain in the $30 a barrel area, Norway-based Rystad Energy said in an analysis on Monday.

"The effect of the COVID-19 virus on global demand for oil and gas, along with an ongoing price war that has sent oil prices tumbling at an unprecedented rate, are poised to wreak havoc on new project development plans for this year," Rystad said.

Per Rystad, exploration and production (E&P) companies are likely to decrease project sanctioning by up to $131 billion, or about 68% year-on-year, "as they batten down the hatches to weather the storm."

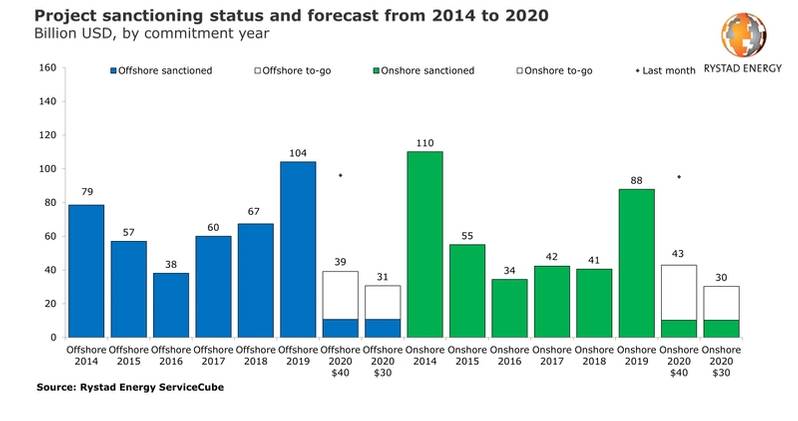

In 2019 total onshore and offshore project sanctioning reached some $192 billion. At the outset of this year, Rystad Energy forecast that projects representing about $190 billion worth of investments would be sanctioned this year. Recent developments, however, have spawned a major revision to that estimate, the energy intelligence firm said.

"If the price of Brent crude averages around $30 per barrel in 2020, which we see as an increasingly likely scenario, we estimate that total project sanctioning will be reduced to just $61 billion. Some $30 billion of the overall expenditure is tied to onshore projects and $31 billion to offshore," it added.

“Upstream players will have to take a close look at their cost levels and investment plans to counter the financial impact of lower prices and demand. Companies have already started reducing their annual capital spending for 2020,” says Audun Martinsen, Rystad Energy’s Head of Energy Service Research. In a $40 per barrel price scenario, which is getting more distant by the day, total sanctioning would still be heavily slashed year-on-year, with Rystad Energy estimating a collective sum of $82 billion, representing a decline of 57%.

In a $40 per barrel price scenario, which is getting more distant by the day, total sanctioning would still be heavily slashed year-on-year, with Rystad Energy estimating a collective sum of $82 billion, representing a decline of 57%.

In North America, multi-billion dollar oil projects, including LLOG-operated Shenandoah Phase 1 and the Shell-operated Whale development, could face short-term delays in the offshore sector due to low oil prices, while in the onshore sector operators are expected to wait for the situation to stabilize before committing to new projects.

"Project sanctioning schedules are expected to face delays of several months – even for those with breakeven requirements of less than $40 per barrel, let alone those with higher costs – as most oil companies will prefer to wait for the spread of Covid-19 to slow down and for the market to start to recover," Rystad said.

Still, Rystad has stressed that one of the major projects that are still expected to get sanctioned this year is ExxonMobil’s Greater Liza development off Guyana, which encompasses the Payara and Pacora discoveries.

Worth noting, its not just new project sanctions that are under threat. A couple of days ago, Canada's Husky Energy decided to freeze works on its West White Rose Project, which was around 57 percent complete (according to February figures).

Also, Norway's Equinor recently decided to delay the plan to develop the Bay du Nord project offshore Canada, despite the FID being expected in 2021, and not this year.