Senegal could as well be on the way to joining the league of top African oil and gas producers in the next three years after developers of one of the most profound offshore discoveries announced reaching a final investment decision (FID).

The Rufisque Offshore, Sangomar Offshore, and Sangomar Deep Offshore (RSSD) joint venture reached the FID shortly after authorities in the West African country granted a 25-year Exploitation Authorization for the first phase of the offshore Sangomar Field Development.

The joint venture is made up of Cairn Energy's subsidiary Capricorn Senegal (40%), Woodside Energy (35%), FAR (15%), and Senegal national oil company Petrosen (10%). Australia's Woodside is the operator of the project.

Reaching FID for the development of the $4.2 billion offshore oil field is also good news for the Senegalese government, which through Petrosen is targeting raising its share of the oil and gas production to at least 20% up from the current 10%. Any progress in the development of the project would be a step closer to the realization of this target.

First oil in 2023

"This is a momentous milestone for the joint venture and the people of Senegal," said FAR managing director Cath Norman in a statement issued Wednesday.

The RSSD JV is looking forward to the first oil in the first quarter of 2023, a culmination of a long exploration and production history in Senegal that dates back to the 1950s but which took a turn for the best in 2014 when Cairn announced two concurrent exploration successes offshore the former French colony.

According to Cairn, the company and its joint venture partners, Woodside and FAR, signed Final Investment Decision (FID) statement in concurrence with Petrosen on Tuesday night in the presence of the Senegalese Minister of Petroleum and Energies, Mouhamadou Cisse.

"Phase 1 of the development will target estimated 2P recoverable oil reserves of 231 mmbbls," said Cairn's statement.

The joint venture partners hope to recover an estimated 500 mmbbls "over the life of the field with the development also planning gas export to shore."

FPSO ordered in Japan

Earlier, Woodside had announced the execution of the purchase contract for the floating production, storage and offloading (FPSO) facility, another critical milestone toward consolidating pre-production planning for the Sangomar field monetization. The FPSO will be delivered by Japan's MODEC.

"We look forward to progressing the project towards first oil in early 2023 and expect that our experience in offshore FPSO developments will support its delivery on cost and schedule," said Woodside CEO Peter Coleman in a statement.

Fast-tracking development of the Sangomar oil field is also good for Senegal, which has listed the development of its power sector on top of its Plan Sénégal Emergent implementation schedule in the drive to transform the country into an emerging economy in the next five years.

Some of the initiatives to achieve the Plan include developing its offshore natural gas resources for electricity generation by 2025 in a bid to reduce the current high import bill for liquid fuels and costs for fossil-generated electricity.

In the last five years, Senegal, with the support of the investment conducive 1998 hydrocarbons law, has made strides in its search for hydrocarbons offshore with discovered oil and gas reserves estimated at about one billion barrels of oil and 40 trillion cubic feet of gas.

A large share of the total reserves has been discovered in the cross-border area between Senegal and Mauritania.

It's not just Sangomar. GTA fields are there, too

Progress toward commercialization of the Sangomar offshore oil field has come nearly two years after Senegal struck a deal with Mauritania for the joint development of the Grand Tortue/Ahmeyim (GTA), which is expected to start gas production in 2022 via an FLNG unit.

GTA Fields are located in the Saint Louis Deep offshore block in the north of the country with estimated reserves of around 15 tcf.

Under the Senegal/Mauritania agreement, both governments will put in place an elaborate field development structure that ensures efficient cross-border unitization of the resource with the initial costs, production, and revenue being split 50-50% "as well as mechanism for future equity redeterminations based on field performance," according to an earlier statement by BP-led joint venture partners.

Attractive oil and gas province

According to Cairn Chief Executive Simon Thomson, the company's "discoveries offshore Senegal from the country's first deepwater wells opened up a new basin on the Atlantic Margin."

"Cairn has operated three drilling programs and successfully laid the foundation for Senegal's first multi-phase oil and gas development," Thomson added.

With nearly 140 offshore wells drilled since the 1950s and profound discoveries made in 2014 and 2016, Thomson feels, and rightly so, that "Senegal is now an attractive oil and gas province, drawing the attention of the global industry."

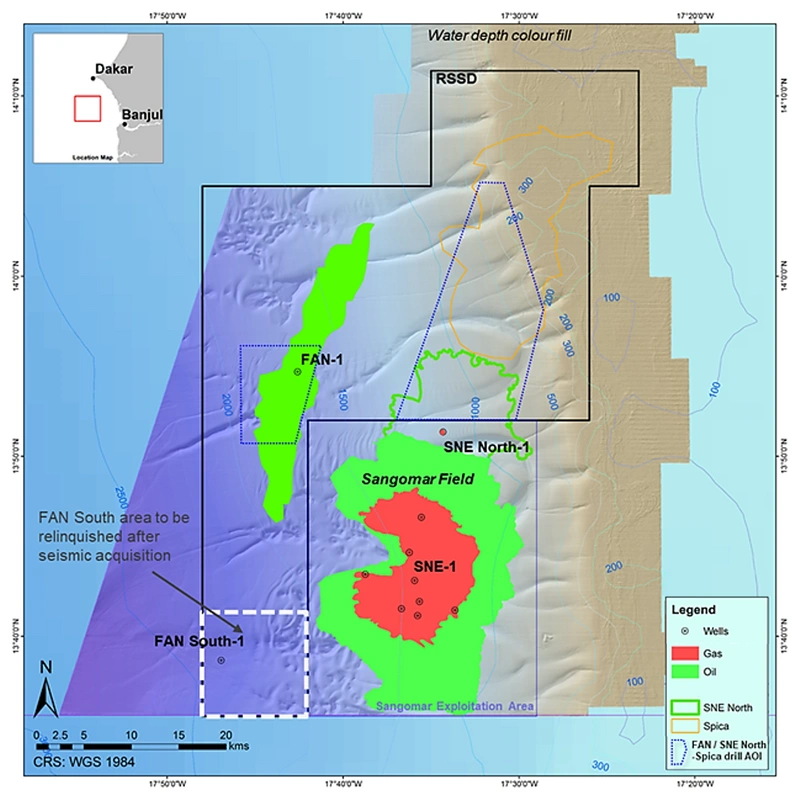

The Sangomar offshore oil and gas field in Senegal. (Image: Cairn Energy)

The Sangomar offshore oil and gas field in Senegal. (Image: Cairn Energy)