Analyses show that the Barents Sea contains significant resources, probably more gas than oil. What needs to be done if Norway is to supply Europe with the requested volumes of gas?

The Barents Sea is like a separate petroleum province on the Norwegian shelf. There are currently three options for exporting more gas from the Barents Sea. One option is a pipeline to connect the Barents Sea to the well-developed pipeline system that runs from the Norwegian Sea to the south and west. This option would make the Norwegian shelf a single petroleum province, tied together with solid and highly-developed infrastructure.

LNG transport

Another option is to expand capacity in the LNG plant on Melkøya, outside Hammerfest in Finnmark county. Today, the LNG plant is the sole alternative for delivering gas from the Barents Sea From here, current gas exports from the Barents Sea are in the form of liquified gas dispatched to the markets using specialised ships. The challenge is that gas from the Snøhvit field occupies all capacity at the LNG plant for a very long time, all the way to 2040.

Without new gas transport capacity, projections indicate that the plant will be fully utilised up to 2050, based on already proven resources in fields and discoveries.

A third option is to use gas from the Barents Sea to produce ammonia, which is then exported by ship.

If a new gas pipeline is approved and built, it would be connected to a well-integrated subsea system for gas transport.

Gassco is responsible for transporting gas to the European continent and to the United Kingdom through this system. The gas pipelines amount to a total of 8778 km of pipe.

Director General Torgeir Stordal at the Norwegian Petroleum Directorate (NPD) talked about opportunities on the Norwegian shelf during the ‘December conference’ in Kristiansund this week, and pointed to the fact that these are troubled times where energy security ranks near the top of the global agenda.

“Norway has a role that is more important than is generally understood. In a country such as ours, where we’re basically self-sufficient in our supply of electricity, many find it difficult to realise the importance of our gas for Brits and Europeans.”

The need for gas

Gas is one of the largest energy sources for generating electricity in Europe, and Norwegian gas covers around one-quarter of Europe’s energy consumption, according to Eurostat. Norwegian gas meets the annual household needs of 800 million people.

In April 2023, Gassco and the NPD presented a study which concludes that increasing transport capacity for gas is profitable from a socio-economic perspective (Norwegian only).

This would further increase value creation in the Barents Sea. The most important observations in the study include that “it would be profitable from an NCS perspective to develop new capacity from the Barents Sea based on proven volumes from fields currently in operation and discoveries based on assumptions stipulated for the solutions that were studied.”

Another observation from the study is that “increased exploration activity to prove more gas resources is important in order to strengthen the basis for new gas infrastructure in the Barents Sea.”

Another point made is that “coordinated development of fields and associated infrastructure is important to maximise value creation.”

“I now have a clear expectation that key companies in the Barents Sea are aware of their social responsibility. This means both that they leave no stone unturned in their quest to find more gas in the Barents Sea and that they continue the work to realise increased gas export capacity from this area of the ocean,” said Minister of Petroleum and Energy Terje Aasland when the study was presented.

The Chicken and the Egg

Many are calling for assurances of larger gas volumes before initiating a process to lay new gas export pipelines. That means a need for more exploration and more discoveries. Some companies have stated ambitions in the Barents Sea and are planning a number of exploration wells in the years to come.

If the infrastructure is developed in the form of, for example, pipelines for export or increased LNG capacity, that will probably trigger more exploration activity in the north. And if major discoveries are made in the planned exploration wells, it will probably be easier to secure funds for investment in new infrastructure.

Coordination is Necessary

The geology in the opened areas in the Barents Sea indicates that it is not very likely that large enough discoveries will be made to warrant establishing new export capacity, on an independent basis.

This means that new export capacity is more reliant on coordination of resources. The energy situation in Europe would seemingly indicate that the need for such a project has grown.

Based on the NPD’s projections, an increasing share of production from 2030 and beyond will have to come from undiscovered resources. And much of this from smaller discoveries.

Exploration activity conducted in the past 20 years has contributed enormous values to society. The Norwegian Petroleum Directorate estimates that the total net present value from exploration in the last 20 years is around NOK 1500 billion, with a seven percent discount rate and NOK 2100 billion with a four per cent discount rate. This activity has yielded total net revenues of more than NOK 3000 billion. Exploration is profitable in all ocean areas – including the Barents Sea.

Undiscovered Gas

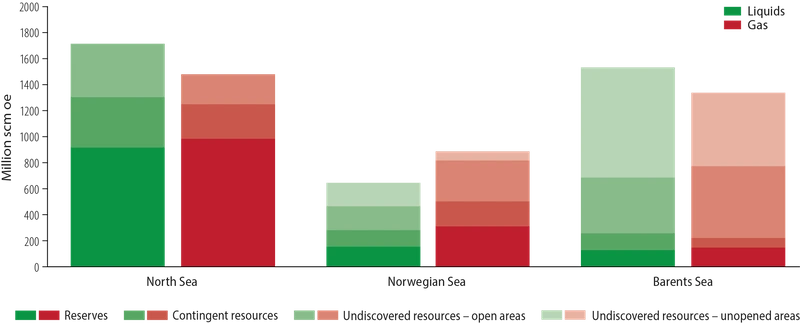

According to the NPD’s estimates, half of the undiscovered gas resources on the Norwegian shelf are found in the southern part of the Barents Sea. If we include the northern Barents Sea – which has not been opened for petroleum activity, the undiscovered gas resources in the Barents Sea account for two-thirds.

Estimated undiscovered resources in the Barents Sea are 2400 million standard cubic metres of oil equivalent (Sm3 of o.e.) (or 15 100 million barrels of o.e.) Gas accounts for 1120 billion Sm3 of this.

Figure from the Resource report 2022: Distribution of remaining liquid and gas resources (expected value) by NCS area and class. Source: Norwegian Petroleum Directorate

Figure from the Resource report 2022: Distribution of remaining liquid and gas resources (expected value) by NCS area and class. Source: Norwegian Petroleum Directorate

Long-term security

Norway is an important and long-term gas supplier to Europe, and Norwegian gas can play a key role in the energy transformation in the EU. In addition to securing energy with a relatively low climate footprint, gas can also be used to balance variable renewable sources such as solar and wind.

If more gas is proven, it could also be used in the future to produce practically emission-free blue hydrogen, which may become an important energy carrier in Europe’s energy realignment.

Norwegian authorities are studying whether the gas infrastructure on the Norwegian shelf, with some modifications, could be used to transport both hydrogen and CO2. Storting White Paper Prop. 97 S (2022–2023) (Norwegian only) highlights energy supply security as more important than ever.

Russia’s military invasion in Ukraine has had substantial consequences in global energy markets. The impact has particularly been felt in the gas market, with very high prices in import-dependent regions such as Asia and Europe.

The situation was further escalated in September 2022, with shutdown of gas flow in the pipeline between Russia and Germany (North Stream 1).

The situation in the energy markets in recent months has heightened awareness surrounding the importance of stabile access to reasonably-priced energy.

Purchasing Gas from the East

Uncertain gas supplies – particularly the loss of Russian gas – have caused nations such as Germany, France and Italy to enter into long-term gas supply agreements with Qatar.

The energy situation in Europe is still quite challenging. The loss of pipeline gas deliveries from Russia came at the same time as much of the new power generation in Europe has been non-adjustable power production.

Without gas to produce power, parts of Europe would have gone ‘dark’ in 2022 when the wind didn’t blow and the sun didn’t shine. The gradual dismantling and production challenges within nuclear power and coal power are important reasons for this.

A global scarcity of gas is expected in the next few years. Therefore, gas prices are expected to remain high in a historical perspective in Europe.

Since the autumn of 2021, the licensees on the Norwegian continental shelf have implemented a number of measures to maintain the highest possible gas export level to Europe. Most of the Norwegian gas production is exported by pipeline to countries in Europe.

There is also a need for potential increased gas volumes from the Barents Sea.

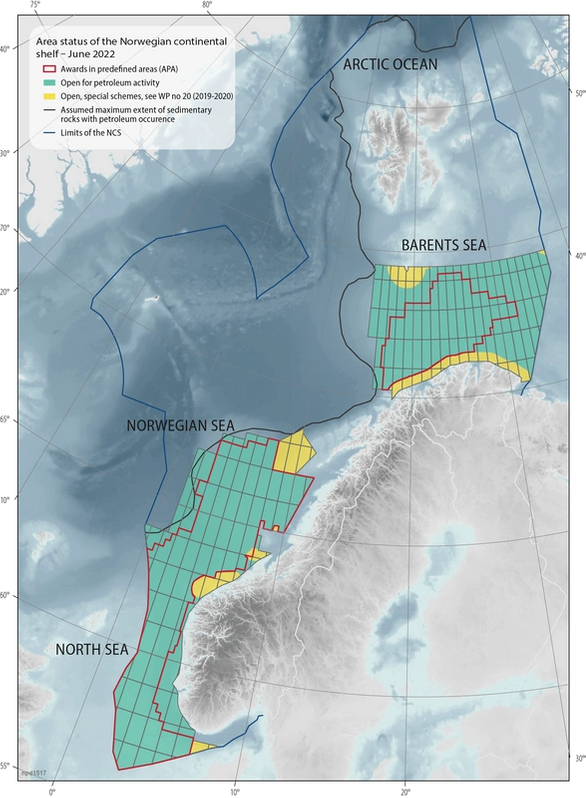

Source: Norwegian Petroleum Directorate Figure from the Resource report 2022: Opened and unopened areas on the NCS. Source: Norwegian Petroleum Directorate

Figure from the Resource report 2022: Opened and unopened areas on the NCS. Source: Norwegian Petroleum Directorate