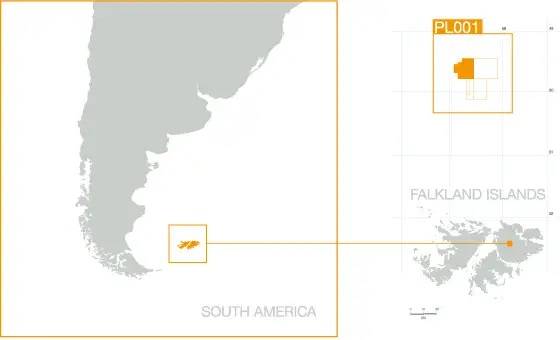

Oil and gas exploration company Argos Resources is set to sell its sole asset, the PL 001 production license in the North Falkand Islands, which is estimated to hold around 3 billion barrels of oil, to JHI.

After completing the transaction, Argos plans to seek to delist from AIM and wind up the company.

In December 2022, Argos Resources agreed for Canada-based JHI to acquire Argos' PL001 Production License interests for new shares in JHI, plus a cash payment enabling Argos to settle the transaction and corporate expenses.

Ian Thomson, Chairman of Argos, said in December: "This is an attractive transaction for both companies, and I strongly recommend that ARL shareholders vote in favor when asked to do so in a general meeting. JHI has ample cash reserves which are more than sufficient to cover the investments required to advance the exploration activities on Licence PL001 and to meet the financial capability criteria to support a licence extension to 31 December 2024."

In addition to the North Falkland Basin Licence PL001, the transaction gives ARL shareholders access to the potential upside in the Canje license, offshore Guyana, in a basin that has been the highlight of the oil industry for several years, enjoying prolific success from numerous giant oil discoveries."

In a statement on Wednesday, Argos said it had entered into the Licence Acquisition Agreement (LAA) under which, the license and related assets will be transferred from Argos to JHI, subject to, inter alia, the approval of the company's shareholders. Argos has had an interest in the Licence since 1997.

As consideration for the license, Argos will be issued with 8,467,820 JHI Common Shares credited as fully paid and £303,500 in cash (of which a non-refundable payment of £151,750 has already been made).

Upon the completion of the divestment, Argos will cease to own, control, or conduct all or substantially all, of its existing trading business, activities or assets, with, assuming completion of the LAA, the company's sole asset holding of JHI Common Shares.

"The [Argos] directors have concluded that in this scenario it is in the best interests of the company and its shareholders to seek shareholder approval for cancellation of the admission of the ordinary shares to trading on AIM," Argos said, adding that the shareholder approval for the disposal and cancellation will be sought at a general meeting on May 26, 2023.

"In the event that shareholder approval for the disposal and cancellation are obtained, it is the intention of the Board that the company should then be wound up by way of a members voluntary liquidation. The company has agreed with certain creditors of the company to settle those liabilities in JHI Common Shares (up to approximately 475,000 JHI Common Shares). Thereafter, approximately 8 million JHI Common Shares are expected to be available for distribution to shareholders pro rata to their holding in the company at that time," Argos said.

Argos has had an interest in the Licence since 1997. Argos had farmed out its stake in the block to Noble Energy (75%) and Edison (25%) in 2015, in exchange for a 5% royalty from future production from any future discoveries, as well as $2.75 million in one-off cash payment and $800,000 per year until the first royalty payment from any future production.

However, a couple of years later, in 2018, Noble Energy and Edison decided to surrender their interests in PL001, without drilling a well in the offshore block. Argos was subsequently reassigned a 100% ownership of the block.

Argos then secured a two-year extension to the license in December 2022, with the license now continuing to run until December 31, 2024)

Argos explained that during this extended period, until December 21, 2024, the company is required to carry out a work program for which it is not funded and there is no certainty, in the board's view, that capital to fund the work program will be available to Argos.

"JHI has the cash reserves to fund this work program and is enthusiastic as to the identified prospects in the license area. It is the Board's view that shareholders' interests are best served by transferring the company's interest in the license to JHI in return for an equity interest in JHI (and some cash) which would provide shareholders with an ongoing interest in the outcome of future work carried out on the license, with upside potential through exposure to JHI's interest in the Canje Block," Argos said.

The PL001 is the company's main asset. It covers an area of approximately 1,126 square kilometers in the North Falkland Basin, and is located near the 500 million barrel Sea Lion field, from which the operator, Harbour Energy, exited in 2021.

According to information on Argos' website, seismic surveys over the license have identified 52 prospects and 40 leads within the license area, and an independent Competent Person's Report attributed to these prospects a total unrisked potential of 3.1 billion barrels of prospective recoverable resource in the most likely case, and a high estimate of 10,4 billion barrels.