Australian oil and gas company FAR Limited said Monday it would withdraw from its offshore blocks in Guinea Bissau after failed farm-out attempts. Separately, FAR said that STAM's takeover offer for FAR had closed, without the offer conditions being satisfied. FAR had urged shareholders to reject the offer.

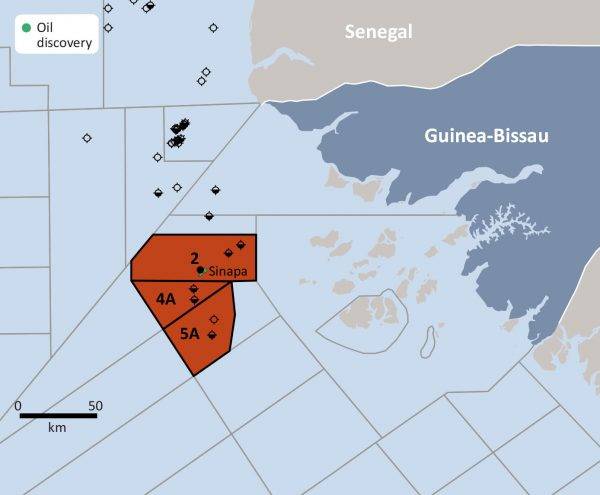

As for the Guinea Bissau news, FAR said that it had started steps to withdraw from its interests in the Esperanca Blocks 4A & 5A and Sinapa Block, 2 offshore Guinea Bissau.

"FAR has provided its notices of withdrawal to the Government of Guinea Bissau and operator Petronor in accordance with the relevant agreements. Joint efforts by FAR and operator Petronor to collaboratively farm-down have been unsuccessful."

"FAR has already met the minimum financial commitments associated with the license, and there are no 2022 commitments in place, therefore FAR does not expect to incur any new material expenses related to these interests. FAR has impaired US$2.7 million of capitalized costs associated with the Guinea Bissau project in the 2021 year," FAR said.

FAR said it had previously disclosed a contingent liability of up to US$13 million payable in the event of production, and a contingent withholding tax liability of US$568k in the event of development, relating to the Guinea Bissau interests.

"In the event of withdrawal FAR will not participate in any future development and production relating to these interests therefore the contingent liabilities will no longer exist," the company said.

STAM Offer Closed

As reported earlier this year, Samuel Terry Asset Management Pty Ltd, in January launched a takeover offer for FAR. The company owned 4.9% of FAR's Shares at the time of the offer. STAM had launched an offer to acquire FAR’s shares at 45c cash per share.

One of FAR shareholders then, Meridian Capital International Fund (MCIF), then deemed the offer "opportunistic and wholly inadequate."

In particular, MCIF said the offer did not offer shareholders any benefit from the Sangomar contingent payment.

Namely, Far last year sold its stake in the Sangomar project in Ghana to Woodside and stands to benefit from Sangomar further, once the field is on stream.

Namely, after the sale, under the agreement with Woodside, FAR may receive future payments of up to US$55 million from the time of first oil production from the Sangomar Field which is targeted for 2023. These payments are contingent on future oil price being above US$58 per barrel.

Separately, FAR had also urged its shareholders to reject the 'opportunistic and inadequate' offer.

In a statement on Monday, Far said the offer had closed.

It said: "Far Limited notes that the Samuel Terry Asset Management takeover offer has closed without the offer conditions being satisfied or waived. Any shareholder acceptances will not be processed. FAR directors had recommended rejecting the offer."