Panoro Energy said Thursday it had received government approvals to sell its interest in the OML 113 offshore block in Nigeria to PetroNor.

The company will sell its stake in Aje Petroleum which holds a 6.502% participating interest, with 16.255% cost-bearing interest, representing an economic interest of 12.1913% in OML 113, which includes the Aje offshore field.

"Receipt of government approvals satisfies the last key condition precedent for the completion of the Transaction. Panoro and PetroNor will now proceed with the final steps to achieve completion of the Transaction, including the issuance of new PetroNor shares for distribution to Panoro shareholders. It is expected that the transaction will close within the next 90 days, and further information will become available in the coming weeks," Panoro Energy said.

John Hamilton, CEO of Panoro, said: "The receipt of government approvals in Nigeria is a major achievement and enables us to now proceed swiftly to completion of the sale of Panoro's interest in OML 113 to PetroNor and unlock value for our shareholders. The divestment is consistent with Panoro's strategy to rationalise and high grade its upstream portfolio, placing emphasis on the allocation of capital to short-cycle oil production projects and focused exploration close to infrastructure hubs.

"The transfer of ownership of OML 113 to PetroNor will allow Panoro to reduce and optimise its capital expenditures while preserving the ability for our shareholders to benefit from future gas successes through the distribution of shares in PetroNor to its shareholders. Panoro is confident that PetroNor is strategically well positioned to unlock the gas potential at Aje for the benefit of all stakeholders."

The ownership of Aje Petroleum is to be shared between the OML 113 operator, Yinka Folawiyo Petroleum (“YFP”) and PetroNor on the basis of a 55 percent and 45 percent shareholding respectively, with PetroNor assuming the role of the technical operator.

"The receipt of this long-awaited consent is exciting news for PetroNor and for the development of OML 113. The Aje Field Development Plan is focused on producing and commercializing gas, and has the potential to provide low emission energy corresponding to 5 percent of the total power production of Nigeria,” says PetroNor's interim CEO Jens Pace. “The terms of the transaction remain the same as per our previous announcements. I look forward to working with our partners on the Aje license and to welcoming the Panoro shareholders into PetroNor."

The two companies first announced the Aje sale and purchase deal in 2019. It was at the time said that PetroNor would pay $10 million plus a contingent consideration of up to $25 million based on future production volumes.

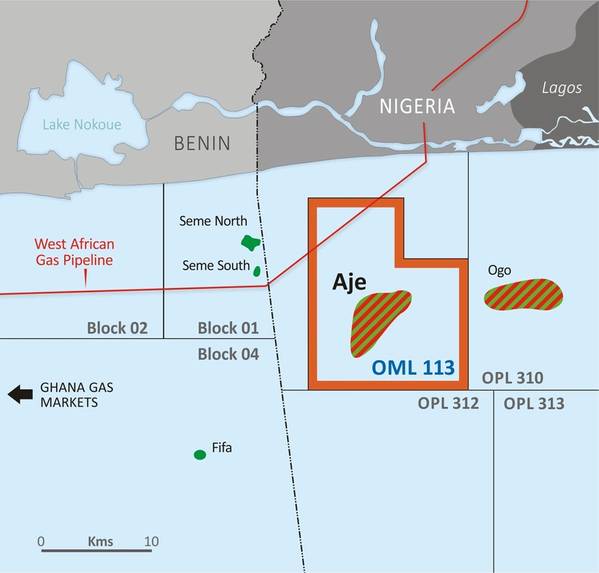

OML 113 located in the western part of offshore Nigeria adjacent to the Benin border. The Aje Field was discovered in 1997 in water depths ranging from 100-1,500 meters. The Aje field started production in April 2016 with oil processed and exported from a leased floating production, storage, and offloading unit (FPSO), the Front Puffin.