A complete subsea factory may yet be a pipe dream. However, with its constituent parts now more or less ready, the industry has a much greater toolbox of technologies with which it can now apply to existing and new subsea developments. But is there willingness, even with the temptation of being able to reduce their CO₂ footprints?

When Equinor’s Åsgard subsea compression project in the Norwegian Sea came on stream in 2015, closely followed by the Gullfaks wet gas compression project, a new era of subsea processing seemed to be opening up.

After years – decades even – of engineering effort, the 2020 subsea factory vision, promoted by Statoil in 2012, looked possible. Yet, it’s now 2021, and they are still the two only projects of their type in operation and, when the next projects start up, there will have been a gap of almost ten years (Ormen Lange in Norway, expected in about 2024, followed by Jansz-Io project, offshore Australia, in 2025).

Slow take-up is not new in the subsea processing world. Despite being the most mature subsea processing technology, subsea boosting (first installed at Draugen in 1993) remains relatively untapped. According to Norwegian analyst Rystad, there are currently only 52 subsea boosting projects worldwide, with about 142 pumps installed.

It’s not for lack of opportunities. According to Rystad’s research, there are some 200 projects globally, 50% of which are brownfield and where the subsea boosting could make an immediate impact by increasing production profitably.

The top 100 of those projects could offer, on average, a 61 million barrel increase in recoverable reserves, per project, with a profit of $11.30/barrel, it says. Half of the projects identified were in the US, with Brazil and Angola following as the countries with the most opportunities. Norway, the UK, Guyana, and then Nigeria follow, in that order.

Erik Vinje, an analyst with Rystad Energy’s energy service team, says that one reason for the low take-up in subsea boosting was system reliability, which was an issue in the early days of subsea boosting. However, reliability has increased in recent years. “It’s mostly (now) about convincing the operators that the technology is mature enough and the reliability is good,” he says.

“Conservative operators are stuck in the past when it comes to this technology.”

In some cases, suppliers have taken on more risks to get projects over the line. Going forward, it might be that more of the smaller operators take up boosting technology, Vinje adds, like deepwater-focused Kosmos Energy and Gulf of Mexico-focused Fieldwood Energy, as they look to tap subsea tiebacks, deepwater projects, and faster payback.

While subsea boosting is a hard sell for some, subsea compression is an even harder one.

“The technology offers numerous benefits, but it requires a substantial amount of [gas] resources to justify the very high investment cost,” says Vinje. “In the current price environment, there are 13 potential candidates with a start-up before 2030.”

But Vinje doesn’t expect 6-7 of these to materialize. Even with increasing incentives around emissions reduction, which could make subsea compression more attractive, the technology itself will need to be smaller and more compact, so that it can also be applied to small to medium-sized gas fields, not just the larger fields, he says.

Emissions reduction high on vendor’s agendas

Hans Fredrik Lindøen-Kjellnes, Principal Process Engineer at OneSubsea, the subsea technologies, production, and processing systems division of Schlumberger, says: “Kg/co2 per barrel of oil equivalent turns out to be one of the most important parameters to measure today,” he says.

“In 2019, almost a third of emissions from Norway came from the oil and gas industry. More than 80% of the emissions from our industry are related to power generation with gas turbines and we know our largest consumers are pumps and compressors. So, to reduce the CO₂ footprint, it makes sense to look at how we’re doing pumping and compression and if we’re doing it in the right way with the right systems for the job.”

Using subsea compression reduces power consumption, Nicolas Barras, Senior Manager, Aker Solutions told UTC.

When comparing topside versus subsea compression for a 100-150 km tieback to shore with a 30-year field life, 35MW would be needed topside compared with 26MW subsea – a 3.6Twh difference of life of field. The energy used could also be provided by offshore wind, he says, which would help limit CO₂ emissions.

This would need to be in areas with reliable winds, and the compressor speed could be controlled and adjusted according to the power available, says Barras, and, with energy storage, there could be further optimization.

The company is also addressing Vinje’s view that smaller, more compact compression systems are needed for smaller reservoirs, not just the large projects. Aker Solutions is doing this by directly coupling the compressor motor to the compressor in a common housing and using active magnetic bearings, reducing the weight of such a system by 30-40%, says Barras.

Dealing with CO₂ - at the seabed

Subsea compression could also be used in areas where fields contain high CO₂ content, says Barras. The CO₂ could be captured “at source” and then reinjected locally, he says, reducing the power needed for reinjection but also reducing the size of the production flowline and the amount of topside equipment needed to condition the gas.

This is something Aker Solutions is working on, says Barras, with qualification of gas separation membranes for subsea carbon capture from natural gas ongoing.

In Brazil, Petrobras, together with Libra Consortium partners, is also looking at high CO₂ concentration gas removal and injection at the seabed at ultra-deepwater high pressure, high gas oil ratio (GOR) oilfields with high (e.g. over 20-30%) CO₂ content, Herbert Prince Koelln, Subsea Engineer at Petrobras told UTC in his presentation made with co-authors Ana Margarida de Oliveira, Fabio Menezes Passarelli and Marcello Augustus Ramos Roberto.

This would be possible through HISEP, Petrobras’ patented high-pressure separation technology, currently in the qualification stage.

The wellstream would first pass through, initially, gravity-based separators, with dense gas being split off to two 6MW pumps in series to be reinjected into the reservoir in a water-alternating-gas loop, and the oil transported topside with a much reduced GOR.

The idea is to help dealing with gas containing high CO₂ content at the seabed and debottleneck surface facilities, which otherwise need significant ancillary equipment to handle huge volumes of gas.

By transferring part of the process (and in the future possibly removing the entire process) from the topside to subsea, with only single-phase pumps required subsea for the reinjection, instead of topside compressors, power consumption is reduced by up to 20% compared with topside compressors, he says.

Overall, a 12% reduction in CO₂ per barrel could be reached, he said.

As part of this work, Petrobras is also testing in a real field application a subsea variable speed drive (SVSD) for a 6MW subsea motor, for applications where subsea power might come from a different platform to the one the oil is being produced to or longer tiebacks, says Koelln.

Moving the VSDs subsea would mean a 35-50% reduction in weight and footprint of the HISEP topside module.

“We have many reservoirs that may apply this technology in the future,” Koelln told UTC, but acknowledges many challenges, not least in control and fluid dynamics and power control for load sharing and transient control, but also subsea cooling and wax control, high pressures, and wide temperature ranges.

Subhead Subsea seawater injection

Subsea water injection could also help reduce CO₂ emissions, says OneSubsea’s Lindøen-Kjellnes. OneSubsea compared topside and subsea seawater treatment and injection systems and found that in a base case 400 m deep field, on a 30 km stepout, choosing a subsea system over a topside one could save about 70,000 tonnes of CO₂ over the life of the field; equivalent to 11.3% reduction potential.

On a cost basis, topside equipment was thought to be less costly than subsea, but once installation and modification costs were taken into account, the two options came close together. Subsea equipment also requires a lot less maintenance and attention during operations, he says, saving costs.

Adding offshore wind into the mix

OneSubsea also compared the CO₂ footprint if offshore wind power was brought into the mix.

“We found that driving such a system with a wind turbine alone wasn’t a very attractive business case,” he says. This was because, due to the availability of wind energy, more pumping capability (i.e. duplicate injection and water treatment systems) would be required for periods when power was available, to make up for the downtime. If offshore wind was combined with a more traditional subsea power topology, such as at Hywind Tampen, excess power generated could be used by other topside utilities, while, during low wind periods, local turbine-generated power would be available.

“Adding a wind turbine to the power system would add some complexity, but in a scenario when we’re anticipating high growth in CO₂ tax, this turned out to be a very attractive business case. I think it represents the way we should think on putting together our systems in new ways to be efficient and to get our carbon emissions down.”

All of these technologies fit into the subsea factory vision. However, while most of the pieces of the subsea factory puzzle are now there, Rystad’s Vinje isn’t convinced we’ll see a full subsea factory development any time soon.

“It’s unlikely we will see a full subsea factory going forward, with operators being very concerned about cutting costs,” he says. “But I think the tools in this subsea processing toolbox will go forward on their own. There are benefits in terms of low carbon solutions, so it’s a way to help operators in curtailing emissions from production.”

Ormen Lange and Jansz-Io in focus

Shell’s Ormen Lange subsea compression project is well over a decade old. Originally, a pilot project was started in 2006, with Aker Solutions as the main contractor for a 12.5 MW pilot subsea compression station tested at Nyhamna. A full development base case was for two 12.5 MW compression stations at Ormen Lange, a 120 km subsea tieback to shore development. However, Shell decided to postpone the project in 2014, citing soaring project costs.

The project was resurrected, however, as a wet gas compression project. In 2019, OneSubsea won an EPCI contract to supply a subsea multiphase compression system for the project, with Aker Solutions managing offshore integration and Subsea 7 supporting on the installation side. Nexans will supply two 120 km-long power cables, with installation expected in 2023. The system – two 16-MW surge tolerant subsea compression stations – will be installed in 850 m of water depth.

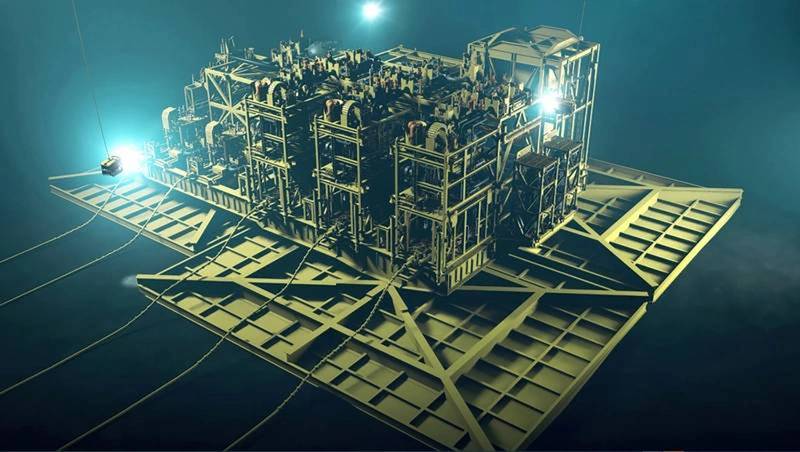

On the other side of the world, in Australia, Chevron is moving forward with its US$4 billion Jansz-Io compression project. Discovered in April 2000, about 200 km off Australia’s mainland, Jansz-Io will feed Chevron’s three-train Gorgon LNG plant, on Barrow Island, which is 70 km offshore. To get the low-pressure reserves to Barrow Island, Chevron is due to install two subsea compression stations, totaling some 6,500 tonnes of subsea infrastructure, supported via a 27,000-tonne normally unattended floating field control station and a 135 km power cable from Barrow Island.

Aker Solutions has the contract to supply the subsea compression system for the project, including three compressor modules and two subsea pump modules, with delivery expected in 2025. Baker Hughes will supply the subsea compression manifold structure, connectors, and controls. ABB will supply the overall electrical power system (EPS) for the project. Worley has been awarded a contract for engineering and construction management services on the project. MAN Energy Solutions has been commissioned to supply five subsea compression units for the Chevron-operated Jansz-Io Compression (J-IC) Project. Images from MAN Energy Solutions.

MAN Energy Solutions has been commissioned to supply five subsea compression units for the Chevron-operated Jansz-Io Compression (J-IC) Project. Images from MAN Energy Solutions.

Tech Talk: Electric Trace Heating (ETH)

A technology that could increasingly support deep and long tieback projects is electric heating, specifically ETH (electric trace heating), thanks to a lower power demand than previous direct electrical heating technologies, says Rystad Energy analyst Erik Vinje.

“We think this is potentially the biggest opportunity here and where we will see the most activity going forward,” he says. “In deeper water and over longer distances, you have increased risk of wax formation. To keep up the flow and production, ETH is a very cost-effective solution for subsea tiebacks, and if you can improve the distance with this technology, I expect adoption to pick up going forward.”

TechnipFMC’s electrically trace heated pipe-in-pipe (ETH-PiP) technology, first deployed on the Islay subsea tieback in 2011, was recently installed on Neptune Energy’s Fenja subsea tieback in the Norwegian North Sea. A 37km ETH-PiP pipeline – the longest in the world – was installed to tie the Fenja fields, in ca. 324 m water depth, back to Equinor’s Njord A platform, and is due to be commissioned in 2022.

Last year, an electrically heat traced flowline (EHTF) pipe-in-pipe solution from Subsea 7 – the company’s first – was deployed on the Ærfugl phase 1 tieback project, in the Norwegian Sea. Ærfugl was tied back with a 20.3 km long EHTF PiP system to the Skarv FPSO. Subsea 7 developed and installed a new EHTF fabrication line at its Vigra spoolbase for the project.

Meanwhile, Subsea 7 set out its second EHTF deployment in the Gulf of Mexico in an OTC paper. The project, BP’s Manuel development, was in more than 2,000 m water depth, said Subsea 7, making it the deepest EHTF installed to date.