The challenges of 2020 have made their mark on offshore rig values but have they reached the trough? Bassoe's Hans Hagelberg takes a deeper look.

It may be the understatement of the decade, but the offshore rig market has had a pretty bad year. The Coronavirus pandemic and collapsing commodity prices have resulted in dozens of canceled rig contracts, many offshore projects delayed by 12 to 18 months, increasing numbers of stacked rigs with no work to go to, operators requesting day rate reductions, and a wave of rig owners going into bankruptcy proceedings – several not for the first time.

Meanwhile, the energy transition has taken off much quicker than most had planned, resulting in many energy companies pledging heavy investment in alternative energy sources in a bid to lower their carbon emissions. This, of course, means less investment left for oil and gas projects as companies begin their move away from fossil fuels, all of which is affecting future rig demand.

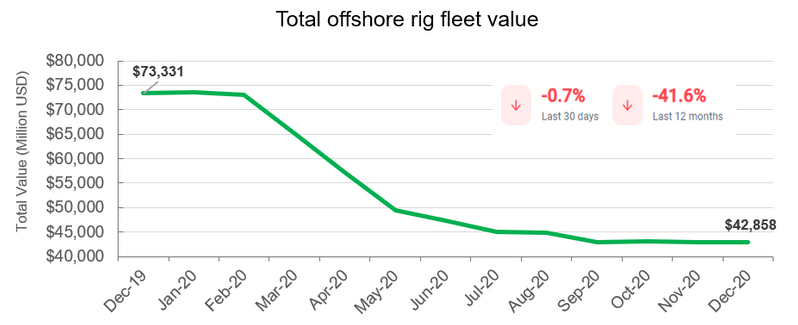

All these challenges have gnawed away at offshore rig values and according to Bassoe Rig Values has resulted in a decrease of almost 42% in just 12 months, equating to a loss of around USD 30 billion (see Figure 1). Figure 1: Changes to offshore rig fleet values from December 2019 – December 2020 (Source: Bassoe Rig Values/Esgian)

Figure 1: Changes to offshore rig fleet values from December 2019 – December 2020 (Source: Bassoe Rig Values/Esgian)

Lack of buying power from traditional parties

Traditionally estimated by rig brokers, offshore rig values are formulated using experience and knowledge of the market and by comparing with recent sales of similar assets. This can be a difficult task if there have been few or no comparable transactions, as has been the situation in 2020, but in this case, the norm is to consider the premise of a willing buyer and willing seller and take a balanced view of the bid/ask value range instead.

This approach is very challenging in today’s struggling offshore rig market, with mostly unwilling or distressed sellers, and the only eager buyers tend to be opportunists looking to scavenge rig assets at exceptionally low levels.

Because most rig owners are in the midst of financial restructuring and there is minimal financial support for purchasing assets, there is an absence of buying power from traditional parties. Many banks and investors that would have previously funded rig acquisitions are moving away from the oil and gas industry and, in the event that capital is available, it is more likely to be invested in public and liquid companies that have low Net Asset Values (NAV) following restructuring.

Cold stacked versus drilling makes all the difference

There are various factors which affect the financial worth of a mobile offshore drilling unit, but its present status (such as if it is drilling or if it is hot, warm, or cold stacked) is fast becoming one of the most significant, especially in today’s tough market.

A large section of the global rig fleet is now cold stacked long term (of the total 103 cold stacked rigs in the fleet, 94 have been cold stacked for 12 months or more) and for these units to re-enter the competitive fleet would require substantial shipyard reactivation programs with costs running to more than USD 100 million in some cases. Therefore, the difference in value of a long-term, cold-stacked rig compared to a similar unit in an active drilling condition has become vast.

For example, Bassoe Rig Values, records a 2011-built drillship at worth USD 30 to 40 million if it is cold stacked, and at worth USD 130 to 140 million if it is on hire and drilling. There have even been cases of 10-year-old, 6th generation, cold-stacked drillships selling for as low as USD 5 or 6 million for recycling – the same units that cost over $600 million to build. When rig values fall too low it can often be more attractive for an owner to sell the unit for scrap (rather than drilling purposes) and thereby prevent it from later re-entering the market as competition.

Investing in the energy transition could bolster values

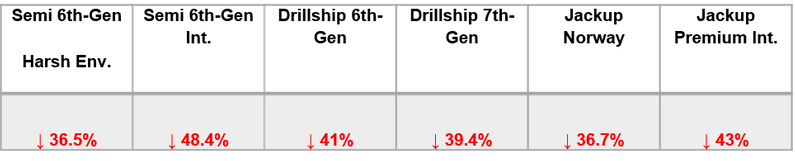

All segments and designs within the offshore rig market have been badly hit this year in terms of value, but as can be seen in Figure 2 there are some segments that have been hit harder than others.

Figure 2: Changes in values in different rig categories from December 2019 – December 2020 (Source: Bassoe Rig Values/Esgian)

Figure 2: Changes in values in different rig categories from December 2019 – December 2020 (Source: Bassoe Rig Values/Esgian)

As mentioned previously, those more modern, well-maintained, hot-stacked or active drilling rigs will be better equipped to hold or increase their values going forward.

In addition to this, rig owners that chose to invest in certain upgrades aimed at fuel-saving or NOx-reduction technology will undoubtedly be ahead of the competition. Therefore, these sorts of investments will also help to bolster the value of an offshore rig, especially as the energy transition continues its intensification.

Improved environment preventing further decreases

There has been some improvement of late in market fundamentals – Brent crude oil reached $50 per barrel last week, rig tendering and award activity is on the rise and scrapping of older rigs is also increasing. Subsequently, Bassoe Rig Values believes that the current improved environment has prevented values from falling further of late.

In the past, appreciation would have been expected at this stage, but at present, there is not enough momentum to drive values upward. To rebalance the market there will need to be a more significant rise in rig demand as well as a substantial reduction in supply, and until the market rebalances, competition for contracts will remain high, prolonging pressure on utilization, day rates and earnings.

However, goals and timelines have been set for the transition to greener energy with little regard to how these will be achieved.

Furthermore, the damage to the economy due to the pandemic will have to be repaired and increased demand for “cheap energy” can be expected. The under-investment in oil and gas will result in production falling more quickly than the increase in alternative energy.

By 2022, this will result in a substantial discrepancy bringing with it improved utilization and day rates, but which will ultimately culminate when alternative energy solutions gather momentum.

Therefore, for some years there will be very attractive return possibilities, but the value of rigs needs to reflect a short pay-back period, maybe as short as three to five years.

Republished with permission. The article above was originally published on Bassoe Offshore's website.

Author

Hans Hagelberg

Hans Hagelberg has 40 years’ experience within the offshore oil & gas industry. With Bassoe Offshore since the early 1990s, he works as an offshore rig broker and on project developments out of Houston and London.