Just as we were beginning to see light at the end of the tunnel, COVID-19 in the space of three months decimated the offshore industry and sent it spiraling into a double downturn.

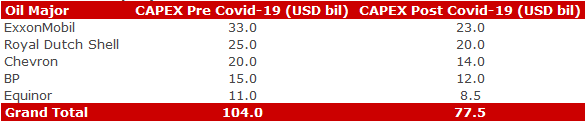

Oil majors have been forced to cut CAPEX (table 1) with E&P spending reduced significantly. This has inevitably filtered down to the MODU sector and many owners have seen canceled contracts, early terminations, or rigs idled.

These factors have all applied significant pressure on the already fragile MODU sector.

Table 1: Oil and Gas company CAPEX

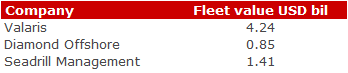

Recently this pressure proved too much, and Valaris, US-listed Diamond Offshore, and John Fredriksen-owned Seadrill announcing it was entering into or exploring financial protection/restructuring citing especially significant business downturn due to COVID- 19 and the global reduction in oil demand. Table 2 shows the total fleet value of each as of 11/06/2020

Table 2: MODU owner total fleet value 11/06/2020

COVID-19 has forced rig owners to seriously analyze their fleet and accept what assets are surplus to requirements.

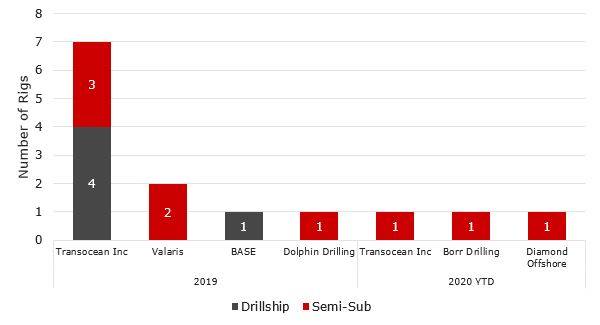

Prior to COVID-19 demolition of Drillships / Semi subs was essentially dominated by Transocean only. See graph 1

Graph 1: Floater Demolition number 2019 and 2020

There were notable demolition transactions pre-COVID 19. The first, Transocean-owned Ocean Rig Paros 10,000ft, built-in 2011 by Samsung, and sold in September last year to Turkish demolition buyer for USD 210/ldt (c. USD 10 mil) ‘as is Piraeus’.

This rig was constructed for USD 680 million in 2008, and the sale represents a c.98% loss in value over the last 10 years.

Also, Petrobras-owned Vitoria 10000, a 10,000 ft drillship built by Samsung Heavy Industries in 2010, was sold at auction to demolition cash buyer Best Oasis for USD 15.05 million. The rig was ss/dd due and laid up in South America.

This rig was constructed for USD c.800 million and similar to Ocean Rig Paros it has lost c.98% of its value over 10 years.

This was not the end of the tale, as a few months later Best Oasis flipped the drillship to Allseas group for USD 24.50 mil.

The rig has been renamed Hidden Gem and is set for conversion to a deepsea mining vessel. A great result for Best Oasis netting USD c.10 mil in a matter of months. However, it is still a low sale price for such a modern rig.

In an illiquid market, transactions like these cannot be ignored and at the time they applied heavy downward pressure on floaters across all ages. So looking forward, what number of rigs can we expect to leave the floater fleet for good?

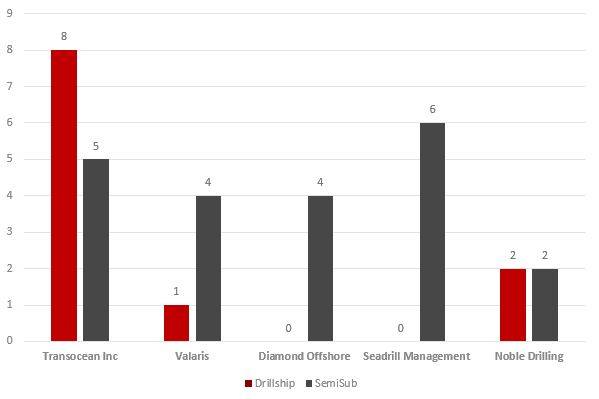

Using VesselsValue recency of AIS tool we can estimate the number of long-term layup floaters and derive the possible number of demolition candidates per company. Note any drillship and semi-submersible that has not signaled in 8 weeks or more is considered laid up.

Graph 2: Top 5 MODU owners based on recency of AIS greater than 8 weeks (Drillships and Semisubmersibles only)

Based on graph 2, 32 floaters across 5 highlighted companies could be demolition candidates.

This is a sizable chunk to be removed from the floater fleet and again if these candidates are a similar age to the Ocean Rig Paros or Vitoria 10,000 it will again have negative pressure on floater values.