A seismic shift in the dialogue around big oil and climate has occurred in the past 12 months. It’s a change in how big oil is orientating itself around what many call the energy transition. Climate goals - governmental, international and industry led - as well as investor behavior (capital flight from fossil fuel) are driving the change.

The landscape is indeed shifting. Andy Kinsella, group CEO at Mainstream Renewable Power, says twice as much capital investment going into wind and solar globally compared with coal, oil, gas and nuclear. In the 1980s, seven of the top 10 companies in the S&P 500 were oil and gas. Now there’s just one, he adds.

The result is that companies – operators and their supply chain – are no longer talking about themselves as oil and gas companies; they’re energy companies, making energy “safer, cleaner and more efficient for people and for the planet”. Talk about the energy transition and decarbonization dominated key conference sessions Offshore Europe, in Aberdeen, in September – when these topics were minor at the previous event.

It’s not an entirely new movement, however. Shell, for example, has been talking about cleaner gas for a while. Its execs tell oil and gas industry events about how Shell is transitioning into a broader energy business. “Shell is one of the largest traders in electricity,” Jo Coleman, Energy Transition Manager for Shell, told Offshore Europe. Shell sees a big future in charging points, at petrol stations and in homes, she says, as well as trying to grow demand in hydrogen and developing carbon capture and storage (CCS).

Aker Solutions has designed carbon capture technology, called Just Catch, that could fit on offshore facilities. (Image: Aker Solutions)

Aker Solutions has designed carbon capture technology, called Just Catch, that could fit on offshore facilities. (Image: Aker Solutions)

Making pledges

It’s not just the majors. At Offshore Europe, industry body Oil & Gas UK (OGUK) launched a Roadmap to 2035: A Blueprint for “net-zero”, calling on industry, government and regulator action to both reduce emissions (UK oil and gas production accounts for 3% of total UK greenhouse gas emissions, says OGUK) and help develop and commercialize technologies like CCS and hydrogen. The same week, the public-funded Oil & Gas Technology Center (OGTC) launched a Net Zero Solutions Center.

Earlier this year, the Netherlands Oil and Gas Exploration and Production Association (NOGEPA) signed an agreement with the Dutch government to cut methane emissions by half within two years – from 8,562 metric tons of methane per year in 2017 to 4,281 metric tons per year by December 2020. Meanwhile, the government there will also run a study to look at ways to further reduce it, such as by electrifying offshore platforms. But, concedes NOGEPA, that might require incentives, as well as guaranteed access to the offshore power grid.

Dutch courage

The Dutch have already been looking at how to better connect their energy system and how offshore wind, gas platforms, hydrogen production and the grid can be better connected to make the best and greenest use of existing infrastructure. Rene Peters, from Dutch research outfit TNO, says that could mean electrifying offshore platforms, which is already happening in some places, but more could be done; connecting power users with generators, like wind farms and potentially opening up marginal fields in doing so, he told the Offshore Energy conference in Amsterdam, in October.

Another option is gas to wire, where natural gas is converted to electricity offshore, then sent by wire onshore. While few options for this were found in the Dutch sector, says Peters, a UK Oil & Gas Authority study last year found 16 potential projects that could be looked at in the UK North Sea. A more viable option in the Netherlands could be hydrogen production offshore, using natural gas and/or offshore wind to power the process then transporting the hydrogen through the existing pipeline network.

Equinor is moving forward with the Hywind Tampen project, which will feed Gullfaks and Snorre with power from floating offshore wind. (Image: Equinor)

Equinor is moving forward with the Hywind Tampen project, which will feed Gullfaks and Snorre with power from floating offshore wind. (Image: Equinor)

Green and blue hydrogen

In fact, a two-year “green” hydrogen (make without use of fossil fuels) pilot project has been agreed, called PosHydon – a spin-out project from the North Sea Energy public-private partnership. From 2020, Neptune Energy, working with re-use group NexStep and TNO, is due to host a 1-megawatt (MW) hydrogen electrolyser on its Q13a platform (the first Dutch powered-from-shore facility) 13 kilometers (km) offshore. The hydrogen, electrolyzed from seawater, will then be blended with the gas and piped to shore in the existing pipeline, to produce electricity. In future, this idea could be linked to offshore wind farms to help level out intermittency issues – i.e. instead of shutting wind farms when they’re over producing, the energy can be converted to hydrogen.

The potential for use of offshore platforms for hydrogen production, powered by renewable electricity, that also supports nearby marginal fields, and hydrogen export to shore, is also being looked at in the UK. The Hydrogen Offshore Production (HOP) project involving the OGTC, environmental consultancy Aquatera, NOV, Doosan Babcock, Cranfield University and the European Marine Energy Center (EMEC) on Orkney, a Scottish island, is assessing options, from the types of technology that could be used to the transportation logistics and the potential to use repurposed offshore facilities. As an example, Hayleigh Pearson, a Project Engineer within the Marginal Developments Solution Center at the OGTC, told Offshore Europe that a small southern North Sea platform like Markham could host four polymer electrolyte membrane electrolysis units to create 3,500 kilograms (kg) of green hydrogen a day (which could power 10 buses driving for 3500km each, she says). A larger northern North Sea platform could perhaps house 22 steam methane reformers and produce 12,000kg of “blue” hydrogen (made with fossil fuel input) per day. Project studies are ongoing with an onshore test center planned for Flotta an island off Orkney mainland.

Meanwhile, Belgian engineering firm Tractebel, part of Engie, is developing a concept for an offshore platform that would convert power produced from offshore wind farms into green hydrogen using electrolysis.

Neptune Energy’s Q13a platform, set to be home to a hdyrogen production facility under a Dutch pilot project. (Photo: Neptune Energy)A connected North Sea

Neptune Energy’s Q13a platform, set to be home to a hdyrogen production facility under a Dutch pilot project. (Photo: Neptune Energy)A connected North Sea

Hydrogen would also feature in the North Sea Wind Power Hub, a mega-island offshore as a hub for connecting massive wind farms and supplying their power to different countries around the North Sea, to manage the grid effectively. It’s a concept launched in 2016 by a Dutch consortium. This year, a feasibility study concluded. Jasper Vis, senior advisor at Tennet, one of the project partners, says it’s feasible. But, instead of one large island, a number of smaller – though still big – islands, either artificial islands or more traditional platforms, depending on the seabed, would be better with electricity conversion to hydrogen when there’s too much power being produced, he told Offshore Energy.

This would suit the Netherlands, which has big offshore wind ambitions but a limited power grid. Rob van der Hage, business manager offshore, at Tennet, told Offshore Energy that the first hub could be built by 2025. It would alleviate grid issues. Hage says that once all the offshore wind farms that are already planned up to 2023 are built, there’s only another 7 gigawatts (GW) of capacity in the grid left. Being able to get power to shore via different routes, i.e. as hydrogen, is an option. The challenge is then is creating demand for hydrogen, he says.

Cleaning industry

Another Dutch project, H-Vision, led by TNO with partners including Air Liquide, BP, Gasunie, Shell and Uniper, seeks to create 3.2GW of blue hydrogen plant in the Maasvlakte area, near two existing power plants, to fulfil 20% of heat and electricity in the Rotterdam area. A final investment decision (FID) is planned for 2021, with first hydrogen in 2026. This project will rely on CCS, with some, though not all, of the CO2 produced in the process potentially being dealt with in another project, the Porthos (Port of Rotterdam CO2Transport Hub & Offshore Storage) CCUS (carbon capture utilization and storage) project, which is being led by the Port of Rotterdam Authority with partners Gasnuie and EBN (a state-owned energy organization). This aims to take CO2 from industry in the Rotterdam port area and both supply it to greenhouses, to aid plant growth, and also store it offshore via Taqa’s P18a platform, 21km off the coast. “By 2030, we expect to be able to store between 2-5 million metric tons of CO2 every year,” according to the project’s website. It’s targeting FID by the end of next year with start-up in 2023.

Meanwhile, Norwegian operator Equinor is also looking at hydrogen. In the H21 project in the UK, it’s been looking at converting the north of England’s natural gas system to use hydrogen, storing CO2 produced in the process, 100km offshore. A feasibility study has been done but a front-end engineering and design (FEED) study not yet funded. Equinor’s also involved in Zero Carbon Humber, a smaller project, to sequester then store CO2 from the Drax power station, a former coal power station converted to biomass.

In the Netherlands, Equinor is also part of Magnum, a project to convert a combined cycle gas turbine to run on hydrogen and then store the CO2. “We need everything petroleum engineers can offer from geology to drilling and completions to ships stakeholder managers, it’s everything,” Anna Korolko, Low Carbon Technology Lead at Equinor, told Offshore Europe.

CCS

CCS and skills from the oil and gas industry plays a big role in this picture. Astley Hastings, a research fellow at the University of Aberdeen, following a career with Schlumberger then a PhD in systems biology, says the oil and gas industry “holds all the cards in order to decarbonize globally”, not least around CCS. Many industries – fertilizer, concrete, steel production – will struggle to decarbonize so CCS is needed, he says.

It’s doable. “CO2 injection for enhanced oil recovery (EOR) has been done for 50 years,” he told Offshore Europe. “Separation (technology) is mature. Metallurgy is known and several pilot projects are active. We understand pretty well CO2/rock chemistry and more research is ongoing. Several governments have sponsored projects, so it’s spade ready.”

But, CCS has been on a bumpy road. There are few projects internationally. Two competing projects in the UK were stopped in 2015 after government funding was pulled. The Snohvit project in Norway stores 0.7 Mt of sequestered CO2 a year in an aquifer via a 153km pipeline and one well. To store all fossil emissions from electricity generation worldwide by 2040 would need 20,500 Snohvits, he says (to store an estimated 15.4 billion metric tons CO2 a year).

From Acorns oaks grow

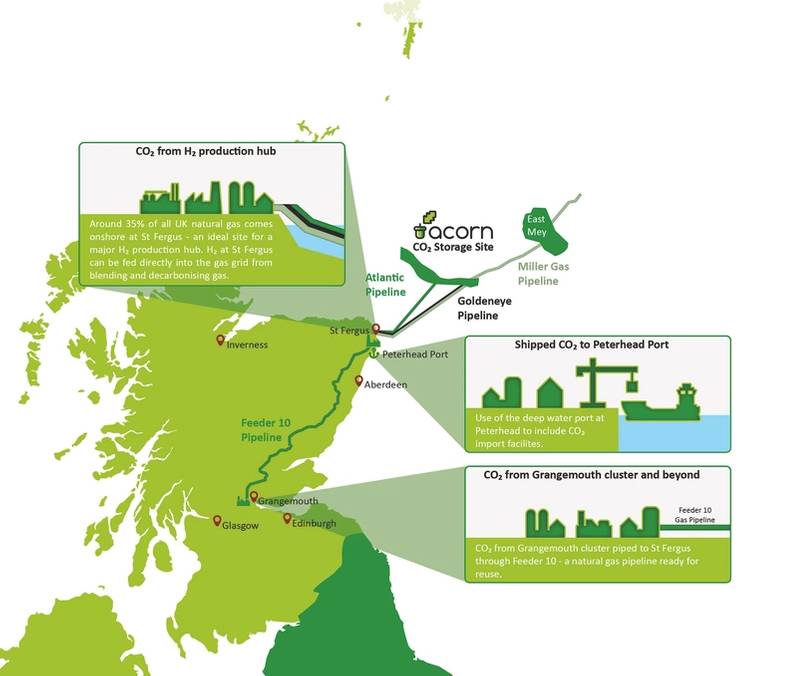

A project that is now getting some traction is Acorn. Pale Blue Dot, its project developer, secured the UK’s first CO2 storage license for the project in 2018. This year, it secured EU funding and new partners including Shell and Chysaor. The idea is to combine reforming some of the natural gas that comes into St Fergus terminal in northern Scotland (that processes 35% of the UK’s gas) to create blue hydrogen and sequester the CO2 created in the process to then store it in fields offshore, re-using existing pipelines, eg. Miller, Goldeneye or Atlantic. It would also store CO2 sent via an onshore pipeline from Scotland’s central belt and transported via ship to Peterhead port.

Sam Gomersall, Commercial Director at Pale Blue Dot, told Offshore Europe that there’s already work to allow 2% hydrogen content in the natural gas grid. A project in Aberdeen is looking to increase that to 20%, locally, then up to 100% following infrastructure conversion work. The group gas funding into pre-front end engineering and design and thinks a project could be up and running by 2024.

Owain Tucker - Global Deployment Leader - CO2 storage, at Shell, pointed Offshore Europe attendees to existing initiatives, such as the Technology Center Mongstad, in Norway, and projects, including Gorgon in Australia, which will sequester 3.4 million metric tons of CO2 a year, and Boundary Dam power station, where CO2 created is captured using Shell technology and then stored at a rate of 1 million metric tons per year for 25 years.

Pale Blue Dot is leading the Acorn CCS project which would see captured carbon stored offshore Scotland. (Image: Pale Blue Dot)

Pale Blue Dot is leading the Acorn CCS project which would see captured carbon stored offshore Scotland. (Image: Pale Blue Dot)

Northern Lights

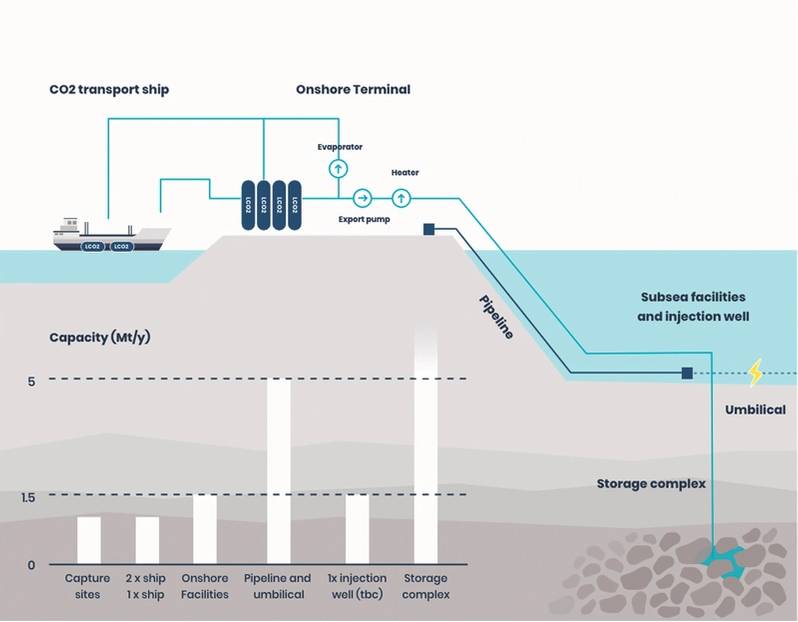

There’s also the Northern Lights in Norway led by Equinor with partners Shell and Total. This could see CO2 shipped from onshore industrial facilities to a coastal site from where it’ll be piped offshore into a saline aquifer for storage. Equinor has a license for Northern Lights and is due to take a final investment decision in 2020, says Anna Korolko, Low Carbon Technology Lead, Equinor, with plans to start operation at the end of 2023. Equinor has already been operating CCS at Sleipner since 1996, with 23 million metric tons stored so far. It also has the Snohvit CCS as well.

Another project, Aramis, back in the Netherlands, is looking to store CO2 from the Rotterdam area. It’s being looked at by NAM, Total and EBN, who are eying the offshore K and L blocks as storage sites, Esther Vermolen, Opportunity Manager Energy Storage at NAM/Shell told Offshore Energy. NAM is also looking to electrify the K14 platform, 90km offshore, using power from wind, saving 130,000 metric tons per year CO2, she says. NAM is looking closely at how CO2 injection will work and is also considering hydrogen storage in depleted fields, she said.

The CCS process can also be offshore to reduce plant emissions. Aker Solutions offers Just Catch, a CCS technology for offshore facilities where they may be too far from shore for a power link, says Ragnhild Stokholm, low carbon champion, at the company. A recent study for Equinor found two trains could cut 240,000 metric tons of CO2 from onboard turbines a year by dissolving the caught CO2 into water then injecting it.

Another option is using renewable power to reduce offshore plant emissions. Norway has been leading on this front, initially from shore such as from Norway’s hydro schemes. Troll was the first field to get power from shore in 2005, followed by Valhall in 2011, with more since, including, most recently, Johan Sverdrup, which in turn will power others.

Equinor is taking this a step further, by installing floating offshore wind near platforms to provide power, an industry first. Its Tampen project, which is due to start up in 2022, will see 11, 8MW floating turbines installed to provide 35% of the annual power demand of the five Snorre A and B, Gullfaks A, B and C platforms, 140 km from shore in 260-300 meters water depth. In October, Equinor awarded contracts worth about NOK 3.3 billion ($360 million) to Kværner (substructures), Siemens Gamesa Renewable Energy (turbines), JDR Cable System (cables) and Subsea 7 (installation and connection) for the project.

These are just some of the projects being looked at – and just in Europe. There appears to be plenty of room to run. Making these projects work commercially will be the next challenge. If this challenge is overcome, the future is looking green. Or perhaps blue.

Equinor leads the Northern Lights project, part of a full value chain carbon capture and storage project offshore Norway. (Image: Equinor)

Equinor leads the Northern Lights project, part of a full value chain carbon capture and storage project offshore Norway. (Image: Equinor)