Oil and gas companies Tullow Oil and PetroSA have decided to pre-empt the sale of Occidental Petroleum’s interests in the Jubilee and TEN fields offshore Ghana to Kosmos Energy, as announced in October.

This doesn’t mean Kosmos will not increase its interests in the said fields, but that it won’t increase it to the level agreed in October.

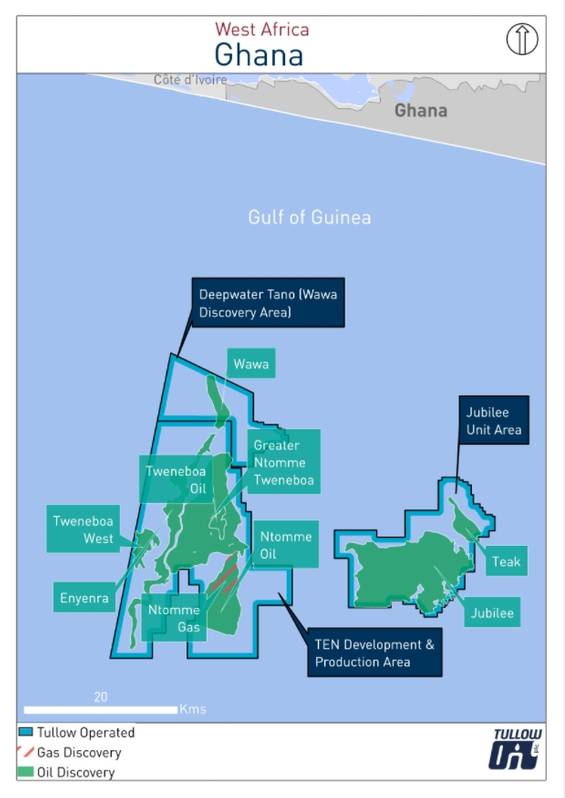

Namely, Kosmos on October 13 said it had acquired an additional 18.0% interest in the Jubilee field and an additional 11.0% interest in the TEN fields in Ghana from Occidental Petroleum (“OXY”) $550 million, increasing its interest in Jubilee to 42.1% and in TEN to 28.1%

The transaction was subject to a 30-day pre-emption period, which, if fully exercised, could reduce Kosmos’ ultimate interest in Jubilee by 3.8% to 38.3%, and in TEN by 8.3% to 19.8%.

In a statement on Thursday, Kosmos said it had been notified by Tullow Oil plc and PetroSA that they intended to exercise their pre-emption rights in relation to the sale of Occidental Petroleum’s interests in the Jubilee and TEN fields in Ghana to Kosmos.

Kosmos said: "The exercise of pre-emption rights is subject to finalizing definitive agreements with Kosmos/Anadarko WCTP Company and requires approval from GNPC and the Ghanaian Ministry of Energy. If completed, Kosmos’ ultimate interest in Jubilee would be reduced by 3.8% to 38.3% (Kosmos retains ~80% of the originally acquired interest), and Kosmos’ ultimate interest in TEN would be reduced by 8.3% to 19.8% (Kosmos retains ~25% of the originally acquired interest)."

Consideration due to Kosmos would be approximately $150 million based on the headline purchase price of $550 million and is subject to certain closing adjustments. Kosmos would anticipate using any potential proceeds to accelerate debt repayment.”

In a separate statement, Tullow said that post-completion, it is anticipated that Tullow’s equity interests would increase to 38.9% in the Jubilee field and to 54.8% in the TEN fields

"The additional equity interests are expected to add c.10% to daily Group production and the associated incremental cash flow will help to accelerate Tullow’s debt reduction," Tullow said.

Rahul Dhir, CEO of Tullow Oil, commented today: ”This is a value accretive, self-funded opportunity for the Group which will increase Tullow’s daily Group production by c.10% and generate additional cash flow to help accelerate debt reduction. Increasing our operated stakes in the Jubilee and TEN fields underscores our commitment to investing in and delivering our Ghana Value Maximisation Plan.

"This opportunity fits well with our strategy to focus on maximizing value from our producing assets. We look forward to constructive conversations with our JV Partners and the Government of Ghana as we finalize the transaction.”