Soaring oil prices could signal the start of an amplified offshore rig market upcycle and this time it might stick around for a while, Esgian's Teresa Wilkie writes.

Last week Brent crude touched $80 per barrel for the first time in three years. What may be even more remarkable is that it has remained above $60 per barrel since February 2021. Meanwhile, there have been various signs that the offshore rig market is now in an upcycle following a cavernous and drawn-out downturn with a lot of false starts.

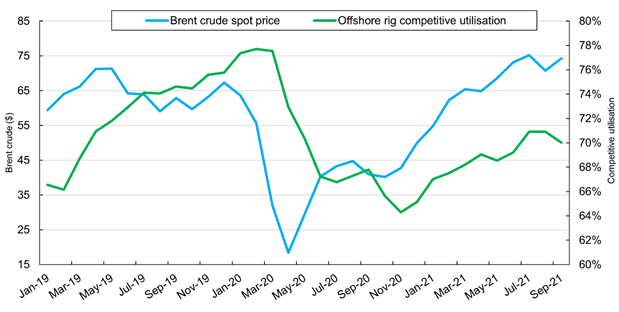

Essentially, rig demand and utilization have started to mirror the higher and more steady commodity prices, as oil and gas companies’ projects become more economical, especially considering that many offshore development break-even levels and project costs have been slashed over the past few years. Figure 1: Average brent crude spot prices versus competitive jack-up, semisub, and drillship utilization (Jan 2019-Sep 2021). Sources: Esgian Rig Service & the EIA

Figure 1: Average brent crude spot prices versus competitive jack-up, semisub, and drillship utilization (Jan 2019-Sep 2021). Sources: Esgian Rig Service & the EIA

Figure 1 shows that there is still a clear correlation between Brent crude and offshore drilling rig activity, although there is around a 2-3 month lag between noticeable shifts in Brent, increased rig utilization, and active rig count (see Figure 2).

The Brent crude spot price average increased from $41 per barrel to $74 per barrel between September 2020 and September 2021, while offshore rig competitive utilization increased from its low point of 64% last year and is on track to hit a high of 80% by January 2022, according to Esgian Rig Service’s demand and utilization forecasts.

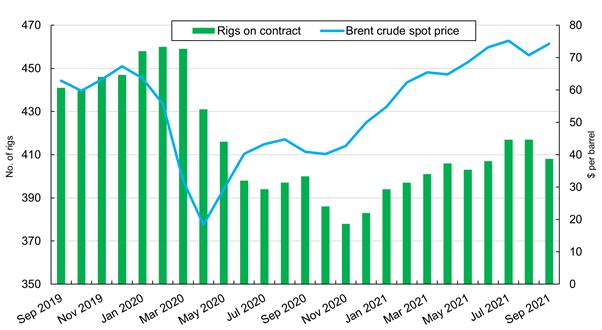

Meanwhile, there has already been approximately 233 years of rig contract backlog added so far in 2021, which is already 14% more than the entire backlog awarded during 2020. In addition, Figure 2 shows that the active rig count has also followed the same trend as the oil price, growing from a low of 378 units last year by 30, to reach 408 units last month.

Figure 2: Number jackups, semisubs and drillships on hire versus Brent crude oil prices (September 2019 - September 2021). Sources: Esgian Rig Service & the EIA.

Figure 2: Number jackups, semisubs and drillships on hire versus Brent crude oil prices (September 2019 - September 2021). Sources: Esgian Rig Service & the EIA.

Depleted resources add credibility to this recovery

Low levels of investment in exploration and appraisal drilling since the end of 2014 has created a strong need to replace depleted resources over the coming years. This is of course part of the reason why oil prices are rising, but it is important to mention because it may indicate we are entering into a longer cycle for improved rig demand.

We have seen indications of this over the past seven years when oil prices increased, but time again it proved to be a false start. However, there seems to be more substance to this recovery due these heavily drained reserves, which is supported by the increase in crude futures prices as well.

Most oil companies are under pressure to lower emissions and investment in fossil fuels but at least some of them are going to need to start producing more oil.

The International Energy Agency (IEA) stated in a 2021 report that “sharp spending cuts and project delays are already constraining supply growth across the globe, with world oil production capacity now set to increase by 5 mb/d by 2026. In the absence of stronger policy action, global oil production would need to rise 10.2 mb/d by 2026 to meet the expected rebound in demand.”

And with more discipline being exercised by shale drillers, who find it far more difficult to attract funding for growth than before, offshore oil and gas production is likely to be relied upon even more. The fear factor for market disruption caused by shale drilling, which we witnessed in the past, appears to be weaker.

There’s likely to be increased rig demand from National Oil Companies (NOCs) and small-to-mid-size independents and focus on shallow-water projects with a shorter runway to production. We also see IOCs putting more investments into deepwater projects even if they’re much more selective than before.

Therefore, Esgiananticipates that there will be continued strong demand for offshore rigs, especially so if the oil price climbs higher and without some new disruptive renewable energy technology or drastic, but much needed, policy action by governments.

About the Author:

Teresa Wilkie is an offshore rig market analyst for Bassoe Analytics with 10 years of experience tracking the offshore rig and subsea vessel markets.