Oil and gas company Tullow Oil has completed the sale of its assets in Equatorial Guinea to Panoro Energy, from which it had earlier on Wednesday received a payment of $88.8 million.

The transaction also includes contingent cash payments of up to $16 million which are linked to asset performance and oil price.

As announced in February, Tullow agreed to sell its subsidiaries with assets in Equatorial Guinea and Gabon to Panoro for up to $180 million.

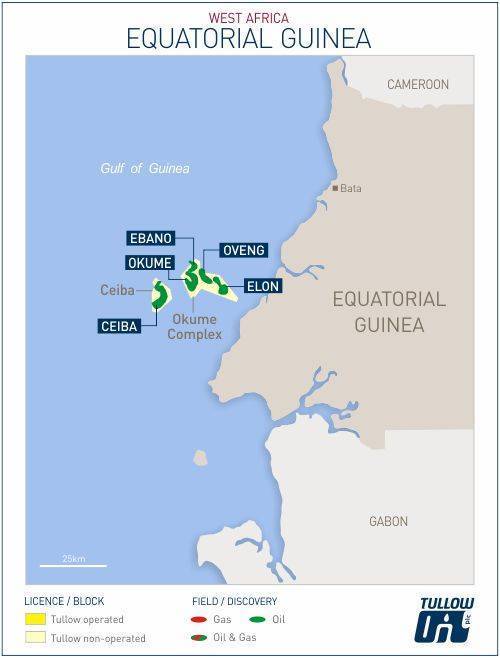

Tullow's E. Guinea subsidiary, Tullow Equatorial Guinea Limited ("TEGL"), which Panoro bought on Wednesday, holds a 14.25% non-operated working interest in Block G, which contains the Ceiba and Okume Complex assets, offshore Equatorial Guinea.

"Although Tullow will continue to have a financial link to the assets in Ceiba and Okume fields, the closing of this transaction marks Tullow's exit from its licences in Equatorial Guinea after 18 years. On receipt of funds, Tullow has net debt of c. $2.3 billion and liquidity headroom of c. $1 billion," Tullow said Wednesday.

Net production to Panoro from these assets is expected to be approximately 5000 bopd in 2021.

John Hamilton, CEO of Panoro, said: "The acquisition of the Block G assets from Tullow marks the first of two closing steps in our previously announced transactions. Together, these transactions are transformational for Panoro, increasing our production and reserves position by a factor of 3-4 times.

"We are very pleased to be joining the Block G JV partnership. We would like to thank the Ministry of Mines, Industry and Energy in Equatorial Guinea for their excellent cooperation to date, and we look forward to creating value together for the country, the JV partners, and wider stakeholders."

Tullow also said that the Dussafu Asset sale in Gabon to Panoro is expected to complete in the second quarter of 2021. A further $5 million consideration is due to be paid to Tullow after both transactions with Panoro have completed. Tullow owns a 10% stake in Dussafu, and Panoro will pay up to $70 million for it.