Oil firm Tullow has struck a deal to sell its assets in Equatorial Guinea and an offshore block stake in Gabon to Panoro for $180 million and will use the proceeds to reduce debt.

Tullow said Tuesday that Panoro would acquire all of its assets in Equatorial Guinea and the Dussafu asset in Gabon.

Panoro will pay up to US$105 million for the Equatorial Guinea transaction, up to US$70 million for the Dussafu Transaction and a further US$5 million consideration to be paid after both transactions have completed.

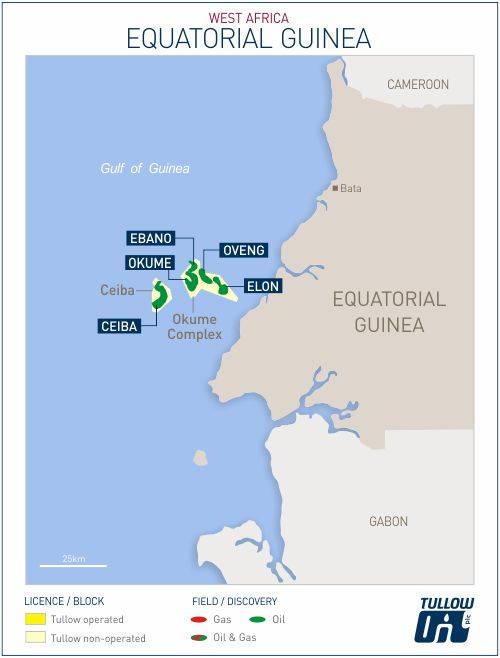

In Equatoria Guinea, Panoro will buy Tullow Equatorial Guinea Limited (TEGL), which has holds a 14.25% non-operated WI in Trident Energy-operated Block G that contains the Ceiba field and Okume Complex.

The Ceiba field was discovered in 1999 and is located in 600-800 meters of water depth on the slope of the southern Rio Muni Basin approximately 35 kilometers offshore. Oil production began in November 2000, with the field being developed in phases with production wells tied back to the Ceiba FPSO through a system of six subsea manifolds and flowlines. The produced liquids are processed on the Ceiba FPSO for export. The field has 16 active production wells and 10 water injectors. Up to the end of June 2020, the field had produced a total of 204 MMbbl.

The Okume Complex consists of five separate oil fields, Okume, Ebano, Oven, Akom North, and Elon, that were discovered in 2001-2. All fields are tied back to a central processing facility (CPF) located at one of the Elon platforms. The processed oil from the CPF is transported via a 25 kilometers pipeline to the Ceiba FPSO for export. The Okume Complex fields have 32 active production wells and 12 water injectors. Up to the end of June 2020, the Okume Complex fields have produced a total of 237 MMbbl.

During 2020, TEGL’s working interest production in these fields was 4,800 bopd.

In Gabon, Tullow Oil Gabon will transfer its entire 10% undivided legal and beneficial interest in the Dussafu Marin Permit Exploration and Production Sharing contract (Dussafu PSC) in Gabon and its interest in and under certain other documents related to the Dussafu PSC to Panoro's subsidiary Pan Petroleum Gabon for US$46 million.

Additional contingent payments of up to US$24 million in aggregate will be payable over a 5 year period once production from the Hibiscus and Ruche discoveries meets an agreed daily average and where oil prices for the relevant year are greater than US$55/bbl.

Completion of both transactions and receipt of funds is expected in the first half of 2021.

Tullow said the deal was an important step in reducing net debt and "enabling the group to deliver US$1 billion of self-help in two years through asset sales, exploration portfolio rationalization and material cost savings."

Value-accretive deals

Rahul Dhir, Chief Executive Officer, Tullow Oil plc, said: "These are important, value-accretive deals for Tullow that will have a positive effect on our financial position as we look to further reduce our net debt and continue constructive discussions with our creditors. These transactions are also in line with our strategy of investing our capital on cash-generative, high return investment opportunities in our core portfolio.

“Our Equatorial Guinea assets have formed an important and stable part of our non-operated West Africa producing portfolio since 2003. We will be exiting Equatorial Guinea after many years of successful investment and co-operation and we thank the Government of Equatorial Guinea for their continued support. Gabon remains a core country of operations for Tullow and we will continue to invest in our assets and seek new opportunities.”

Tullow in 2019 launched a business review, including a detailed reassessment of the group’s organizational structure, cost base, future investment, and asset portfolio plans. This resulted in the sale of assets in Uganda to Total E&P Uganda B.V. for US$575 million in 2020 and completion of an organizational restructuring which, the company said, is expected to deliver sustainable annual cash savings of over US$125 million.

The company also exited a number of licenses and countries, and in November 2020 presented a new business plan, focused on short-cycle, high-return opportunities, and "the substantial potential associated with Tullow’s producing assets within its large resource base."

Tullow expects the new business plans and "a rigorous focus on costs to generate material cash flow over the next decade, which the Group anticipates will enable reduction of its current debt levels and deliver significant value for its host nations and investors."

Panoro: Significant upside potential

Dussafu Permit - Credit: Panoro

Dussafu Permit - Credit: Panoro

Panoro said that the assets being acquired from Tullow comprise seven high quality, non-operated oil production fields within Panoro’s core area with combined additional net production of 6,900 bopd and net 2P reserves of 25 MMbbl.

The company said that the EG Assets comprise six producing oil fields in water depths of 50-850 meters, approximately 35 kilometers from shore, with current net production, is approximately 4,500 bopd, with a potential to grow - close to 8,000 bopd net in 2023-25 driven by facility upgrades, well workovers, perforation of behind pipe zones and infill drilling.

"The assets have excellent operators, low operating costs, and significant upside potential with 2C resources of 29 MMbbl and material exploration potential. Through the acquisitions, the company will increase its net interest in its core asset Dussafu from 7.5% to 17.5% and achieves significant diversification through the entry into Block G, offshore Equatorial Guinea, which comprises six producing offshore fields through the Ceiba and Okume Complex assets," Panoro said adding that Equatorial Guinea acquisition represented a new country entry for Panoro.

"The Dussafu Acquisition will significantly increase Panoro’s exposure to the near-term production and considerable upside potential from this high-quality asset. Following the completion of the Dussafu Acquisition, Panoro’s net WI 2P reserves at Dussafu will be approximately 19 MMbbl, and net WI production from the field is expected to increase from 1,200 bopd to approximately 2,800 bopd (2021 operator estimate)," Panoro said.

The Dussafu block is operated by BW Energy.