Ghana expects Norway's Aker Energy to make a final investment decision in the near future regarding the West African country's planned Pecan oilfield development, Ghana's President Nana Akufo-Addo said on Monday.

The government has been frustrated by the slow pace of offshore development and asked the country's parliament last November to revise its licensing laws in an effort to spur production.

"We expect that within one month or two the final (investment) decision could come," Akufo-Addo told a news conference in Oslo.

He said the Pecan field development would be a "major investment" for Ghana, without elaborating.

Investment firm Aker ASA, a major shareholder in Aker Energy, last November said the estimated $4.4 billion Pecan project faced delay over disagreement on regulations.

"Aker Energy is, in collaboration with relevant authorities and license partners, working on an updated plan for the Pecan field, on which an approval and a subsequent final investment decision (FID) would be based," an Aker Energy spokesman said in an email to Reuters.

Related: Aker Energy, Yinson Sign Pecan FPSO LoI

"The updated plan will be finalized more or less within this timeline (of one or two months), followed by an approval process leading up to an FID," he added.

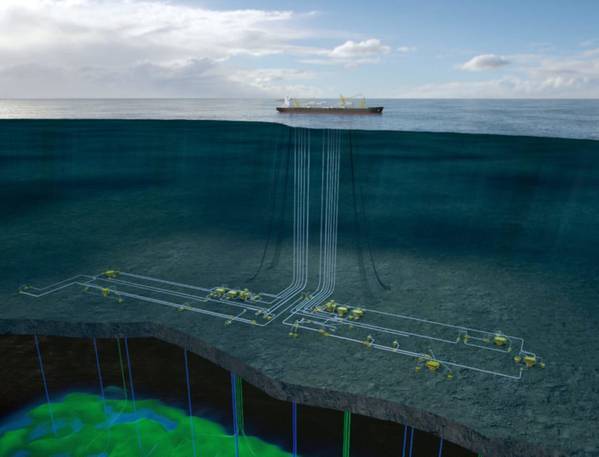

Aker Energy submitted an initial plan to Ghanaian authorities in March 2019, aiming to develop 450-550 million barrels of oil equivalent (boe) at Pecan, and with first oil expected to come three years after the final go-ahead has been decided.

At that time, it also said that the wider area could potentially hold up to a billion barrels of oil equivalent in recoverable resources.

In late 2019, the company changed strategy however, focusing on making the field development economical on a stand-alone basis, and not counting surrounding reserves.

Last week, Aker Energy signed a preliminary deal with Malaysia's Yinson Holdings Berhad for the lease of a floating production, storage and offloading vessel (FPSO) for Pecan, in a sign that the project was moving forward.

Aker Energy holds a 50% stake in the Deepwater Tano Cape Three Points block off Ghana, which includes the Pecan field.

Russia's Lukoil has a 38% interest, Ghana National Petroleum Corporation 10% and Fueltrade 2%.

(Reporting by Nerijus Adomaitis; writing by Terje Solsvik; editing by Gwladys Fouche and Jason Neely)