It's true that the offshore vessel market is still suffering, but that's not to say there aren't glimmers of positivity.

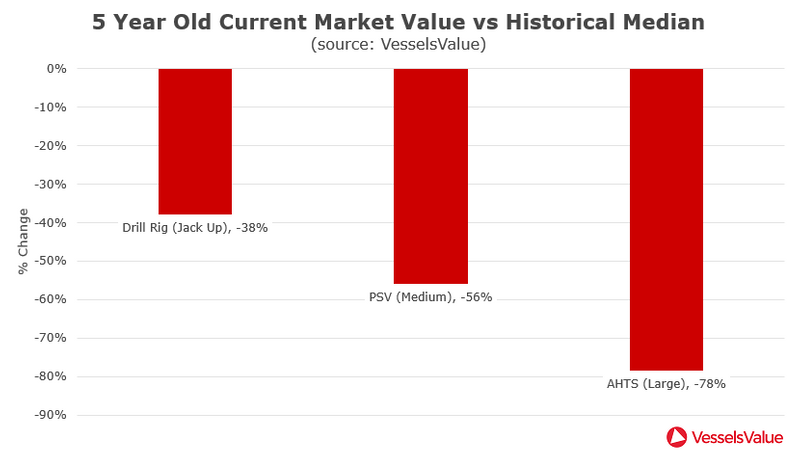

Asset values remain at historic lows throughout much of the offshore sector, but the anchor handler market has been hit hardest, says VesselValue's head of offshore Robert Day.

Five-year-old large anchor handling tug supply vessels (AHTS) (12,000 BHP) are trading nearly 80% below their historic median, he says.

The analyst says rates in Southeast Asia in have suffered significantly, "partly due to their geographical proximity to the yards where vessel availability is high, but also due to a lack of rig activity and subsequent supply boat work in the area."

"This has had a knock on effect in the Middle East as owners from the Southeast Asia region have shifted their tonnage, causing further oversupply. From an asset standpoint, the vessel type east of the Suez that has suffered the most as a result of this is the anchor handlers," he adds.

While those in the anchor handler sector are clearly suffering, it's not all doom and gloom offshore. The market will return, Day believes, it is just a question of when.

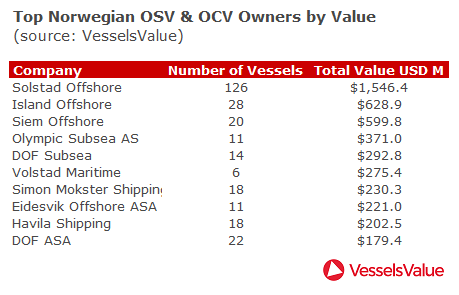

Day says he has observed improved sentiment in the North Sea offshore support vessel (OSV) market where fleet utilization is currently better than the global average. Among other positives, rates in the region are also trading above their two-year seasonal averages, and vessels are being reactivated to reflect this.

He adds that the subsea market – which includes offshore construction vessels (OCV) – has suffered in value but has the best utilization rate. "There remains a forward workbook of subsea projects, and several new high-profile contracts have been awarded in the North Sea since the beginning of 2019."

In addition, North Sea platform supply vessels (PSV), when traded on the spot market, can experience "very healthy returns," Day says. "Once these earnings stabilize, they will result in higher term rates, which will in turn cause asset values to rise."

"The Toisa bankruptcy sale produced a number of interestingly priced opportunities, and we have also seen the likes or Bourbon and Solstad selling off quality assets to reduce debt on their balance sheets," Day says.

"In terms of fleet value, diversity is the key," he says. "Owners with a mixed fleet of both supply and construction boats have the largest fleet size to value ratio."

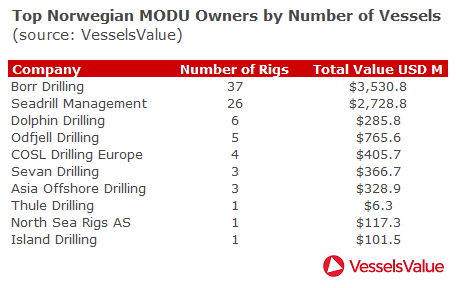

Day says he expects the landscape in the North Sea is evolving, in part, due a changing competitive environment across the pond.

"Following its merger with GulfMark and its successful reemergence from the Chapter 11 process, Tidewater is one to watch in the North Sea arena," Day says. "Once more in a comfortable position financially, Tidewater has an advantage over its competitors in that rates and purchasing moves can be both aggressive and competitive. They are able to purchase distressed asset or fleet opportunities, and will be sure to further shake things up in the North Sea in the near future."

Day believes the merger and acquisition trend will likely continue as US owners emerge from Chapter 11 "leaner, meaner and looking to expand their global footprint".

"Smart operators such as Tidewater and GulfMark have already capitalized on this, as have others such as the Scorpio Group and Nordic American Offshore, and I would predict that we will see further moves of consolidation from both sides of the pond throughout 2019."

"European owners are starting to see more support in their restructuring attempts as new market players and financiers start to take aim at the offshore sector off the back of better fundamentals," Day says. "Chinese financiers are starting to come to the table, providing protection and support for the European community in the same way Chapter 11 provides that for the US market."