Carbon capture and storage has emerged as flashpoint at the UN climate conference in Dubai about how big a role it is destined to play in reaching the target of net zero emissions.

It has also prompted an unusual and bad-tempered confrontation between senior officials at the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC).

In the run up to the conference, the IEA called on oil and gas producers to let go of "the illusion that implausibly large amounts of carbon capture" are the solution to reducing emissions and reaching net zero targets.

OPEC hit back accusing the IEA of finger-pointing, vilifying producers and using an "extremely narrow framing" of the challenges in reaching net zero that downplays energy security and affordability.

Carbon capture has become a proxy for a broader political and diplomatic battle about the future for oil, gas and coal production in a world theoretically committed to achieving net zero emissions by 2050.

NICHE TECHNOLOGY

Carbon capture utilization and storage are currently small-scale technologies that play a niche role in enhanced oil recovery and cleaning up methane from natural gas wells for sale. In 2022, IEA data shows 45 million tonnes of carbon dioxide (CO2) were captured compared with total energy-related emissions of 37 billion tonnes, a capture rate of just 0.1%. Under policies already announced by governments, the IEA projects the amount of CO2 captured will increase to 440 million tonnes a year by 2030 and 3.5 billion tonnes a year by 2050.

To achieve net zero emissions by mid-century, the IEA predicts capture would need to increase to 1 billion tonnes a year in 2030 and 6 billion tonnes a year in 2050.

Even under this more ambitious scenario, however, capture would account for just 10% of cumulative emissions reductions between 2022 and 2050. Carbon capture's role is limited because the process is expensive, requiring enormous amounts of energy and water to separate CO2 from other gases, as well as heavy upfront capital expenditure in capture plants.

Even if costs fall as the technology is deployed more widely, large-scale capture would only be commercially viable in a scenario with a high implicit or explicit price on emissions. But in a world characterised by a high price on emissions, other routes to net zero would become more viable and probably prove simpler, including grid-scale battery storage and hydrogen. Carbon capture's role is likely to be restricted to industries such as cement, chemicals, and steelmaking that are hard to decarbonise by other means and produce large streams of relative concentrated CO2 as a waste product. It is unlikely to play more than a minor role in reducing emissions from electricity generation.

CAPTURE COSTS

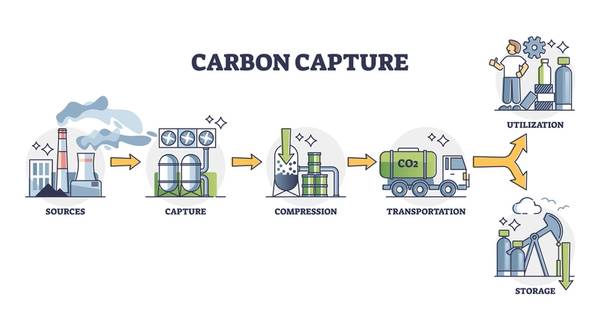

In the four-stage CCS process, carbon dioxide is captured, compressed, transported by pipeline, and injected underground or used as an industrial input. Capture is the most expensive stage because the CO2 must be separated from other gases such as oxygen, nitrogen and methane, which uses large amounts of energy and water.

Process efficiency depends on the concentration of CO2 which is why it is most cost effective when paired with industrial processes that produce relatively pure CO2 in their exhaust streams such as cement manufacturing. In electricity generation, where the waste stream is less concentrated, there are three main routes to capturing CO2 emissions:

Post-combustion capture is the most mature technology but the low concentration of CO2in power plant exhaust streams makes it expensive. Pre-combustion capture attempts to solve the problem by treating or gasifying the fuel before burning it to remove a high-purity stream of CO2. Gasification has been used in the coal-to-liquids industry since the 1930s but has never successfully at scale for CCS and early pilot projects have not been encouraging. Oxy-combustion is a variation on post-combustion capture in which the fuel is burned in pure oxygen rather than air, resulting in a much higher concentration of CO2 for capture. But purifying oxygen is itself energy intensive and expensive. Only the simple post-combustion system can be considered relatively mature technology for widespread deployment in the electricity sector.

But in a power plant fitted with post-combustion capture technology, the capture process uses up between 15% and 40% of the total electrical output, an enormous energy penalty. Water consumption is also 25-200% higher than for a conventional power plant, limiting capture in areas where water is scarce. And capital costs of building a power plant with post-combustion technology are roughly double those for a conventional plant without it.

As a result, post-combustion capture systems are likely to increase the cost of electricity by 50-100%, making CCS unviable without subsidies or a high CO2 price.

STORAGE ISSUES

The other stages of the CCS and CCU process are less expensive but raise practical, safety and social acceptability issues that could limit widespread adoption, according to the most recent UN climate assessment in 2022. Compression and pipelines are well-established technologies; costs are likely to be moderate unless CO2 has to be transported over very long distances.

But storage creates more challenges because CO2 needs to be locked away for hundreds of years without escaping to reduce the climate impact. CO2 is toxic, a threat to human health and life in concentrations of as little as 4%, so the integrity of underground storage must be carefully planned and monitored.

CO2 is normally stored by injecting it hundreds or even thousands of metres underground into depleted oil and gas fields or deep saline aquifers. If CO2 is injected into depleted fields to enable the recovery of more oil and gas it can improve the economics of the project but results in a smaller emissions reduction. Global geological potential to store CO2 has been estimated at 10,000 billion tonnes, split between oil and gas reservoirs (20%) and saline aquifers (80%), which is more than enough for the foreseeable future.

But the distribution of potential storage is uneven and not all potential sites will prove geologically or politically suitable. The United States, Canada, the former Soviet Union, and the Middle East have lots of potential storage, but there is much less in China and Western Europe.

The political and social acceptability of large-scale underground storage remains uncertain, but it may be easier in communities with a history of oil and gas production or offshore.

(Reuters: John Kemp is a Reuters market analyst. The views expressed are his own)