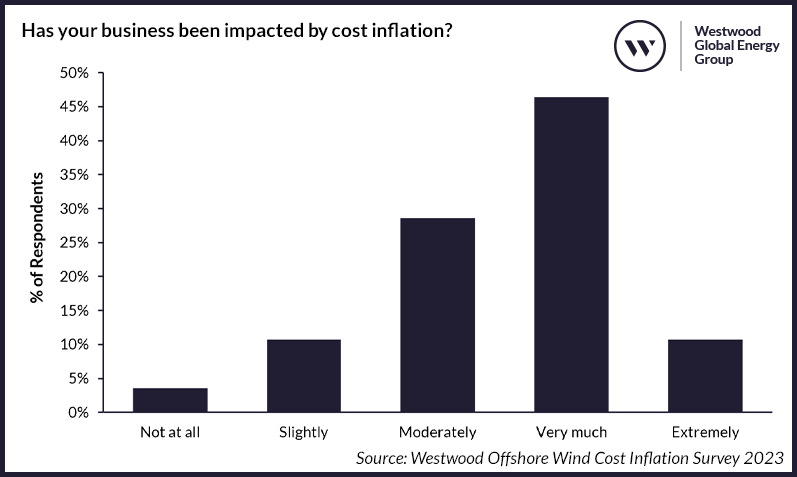

In a Westwood survey on offshore wind cost inflation, nearly three-quarters of industry players indicated that they had started reviewing the viability of their projects in light of recent cost increases, with over 90% indicating that decision-making had slowed as a result.

The survey and market analysis by Westwood explores the impact of inflation on global offshore wind development.

Peter Lloyd-Williams, Senior Commercial Wind Analyst, Westwood said: “Inflation has been one of the key challenges facing the global economy over the past 24 months, and offshore wind has been no exception, grappling with both specific and general inflationary factors.

OEMs have incurred significant losses, while developers have delayed projects in the face of shrinking margins. However, precise details on the extent of rising prices and their proximate causes have - until now - remained elusive.”

To address this information gap, Westwood’s market study in 1H 2023 explored three potential themes: the extent of cost inflation, the causes of cost inflation and its possible consequences.

"A plurality of respondents (32%) indicated that they had seen cost inflation of 11-20% since 2021, with a smaller number reporting cost increases north of 30%. In addition, some reported that financing and commodity prices specifically had risen by over 40%," Westwood said.

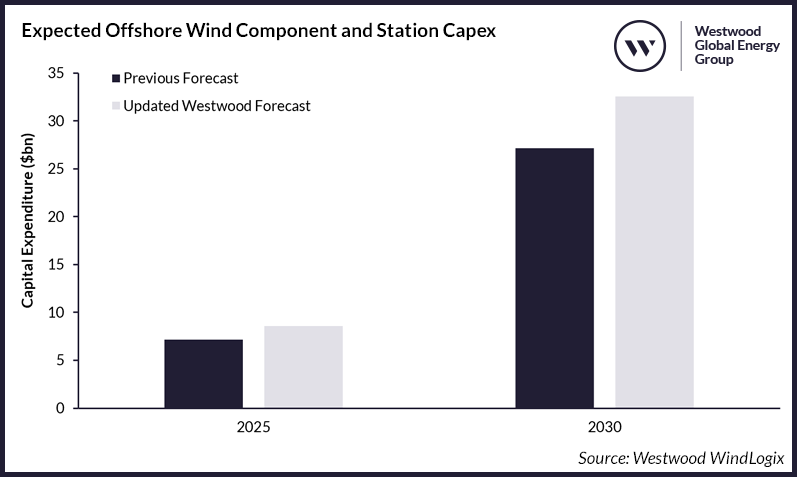

In response, Westwood’s internal analysis suggests that recent cost inflation could add roughly $280bn in capital expenditure for the offshore wind industry (ex-China) over the next decade.

Financing this expenditure gap could ultimately take the form of higher offtake prices funded directly by consumers or indirectly through additional fiscal and tax incentives.

Lloyd-Williams continues: “With margins in many parts of the industry already being squeezed due to attempts to make offshore wind more cost competitive in general, cost inflation may prove extremely challenging for some businesses. At this stage, however, most of our respondents appeared committed to the offshore wind industry and were not seeking to reduce headcount or withdraw from the industry.”

“Whatever happens next, industry players will be closely watching how a period of cost inflation affects a sector that has been defined by falling costs for some time.”