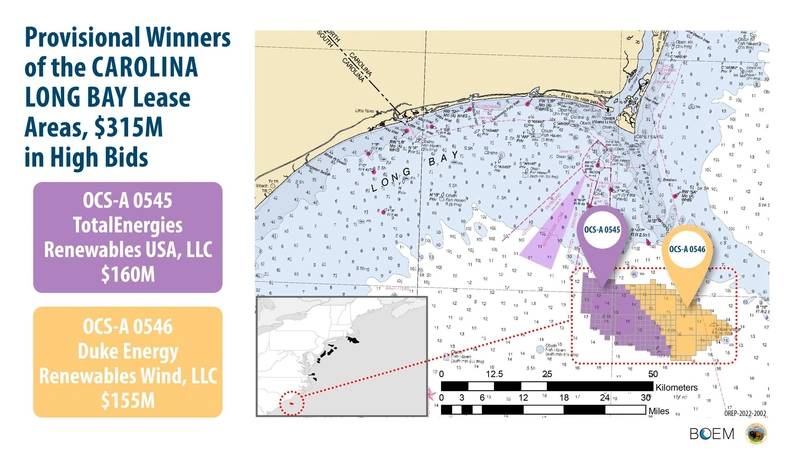

On Wednesday, French oil & gas major TotalEnergies and U.S. utility Duke Energy were declared provisional winners of the two lease areas auctioned by BOEM, the federal agency in charge of offshore wind area leasing and project permitting.

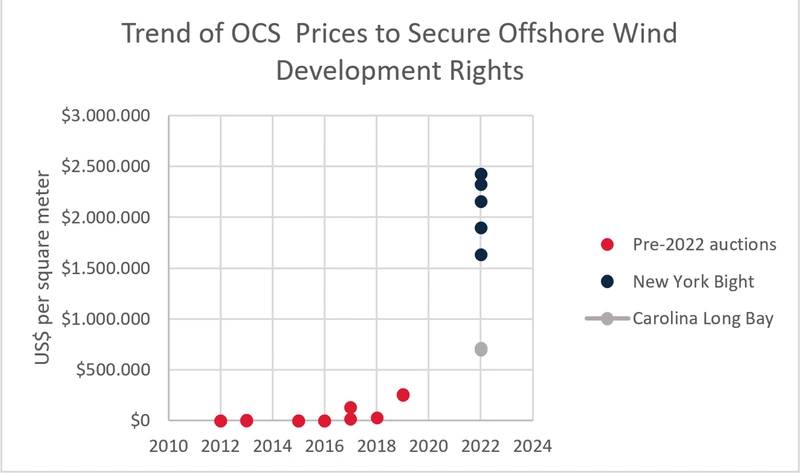

Whilst the results can be seen as a positive indicator of the health of U.S. offshore wind market in the context of pre-2022 auction activity, the winning bidders secured development rights at considerably lower rates than those seen in the recent New York Bight auctions.

The comparatively shallow water sites cover 110,091 acres offshore North and South Carolina on the Outer Continental Shelf are estimated to be able to support at least 1.3 GW of offshore wind capacity.

EXHIBIT 1 PROVISIONAL WINNERS OF CAROLINA LONG BAY OFFSHORE WIND LEASES - Source: BOEM

EXHIBIT 1 PROVISIONAL WINNERS OF CAROLINA LONG BAY OFFSHORE WIND LEASES - Source: BOEM

TotalEnergies bid $160 million and Duke Energy $155 million. Whilst the average rate paid is close to three times the average paid in the last pre-2022 auction, it is also three times less than the average from this year’s New York Bight wind leasing activity. Exhibit 2 maps the prices paid by developers to secure development rights for offshore wind farms to date.

Exhibit 2 - Credit: Intelatus Global Partners

Exhibit 2 - Credit: Intelatus Global Partners

Whilst the New York Bight auction for six lase areas spanned three days and 64 rounds, the Carolina Long Bay auction lasted a day and was concluded after 18 rounds.

Reasons for the difference in interest levels compared to the earlier New York Bight auction include quality of wind resource, size of the retail market, retail electricity prices in the Carolinas, raw material and labor cost inflation, concerns around the cost escalations and state energy commission review of Dominion Energy’s offshore wind project in Virginia and a Trump era presidential moratorium impacting offshore wind developments off the South Carolina.

As with the recent New York Bight lease auction, the Carolina Long Bay auction terms include requirements to accommodate potential modifications to the transmission model for electricity produced offshore. The lease terms also include two supply chain requirements. The two winning bidders have committed to developments amounting to $42 million of investment in domestic supply chain and workforce capability.

Meeting these two supply chain commitments can earn a developer a 20% credit on their cash bid.

Carolina Long Bay and all other U.S wind developments are discussed in Intelatus Global Partners’ May U.S. Offshore Wind Report. Also in the project section of the report are details for over 60 projects in the planning stage, two projects in construction, and two wind farms currently in service. The report is accompanied by an online database. Information is current as of May 3, 2022.

For more information about the U.S. Offshore Wind Market Forecast, please visit www.intelatus.com or contact Michael Kozlowski at +1 561-733-2477or Philip Lewis at +44 203-966-2492