Brazilian oil firm Petrobras is looking to exit its U.S. Gulf of Mexico joint venture with Murphy Oil by selling its 20 percent interest.

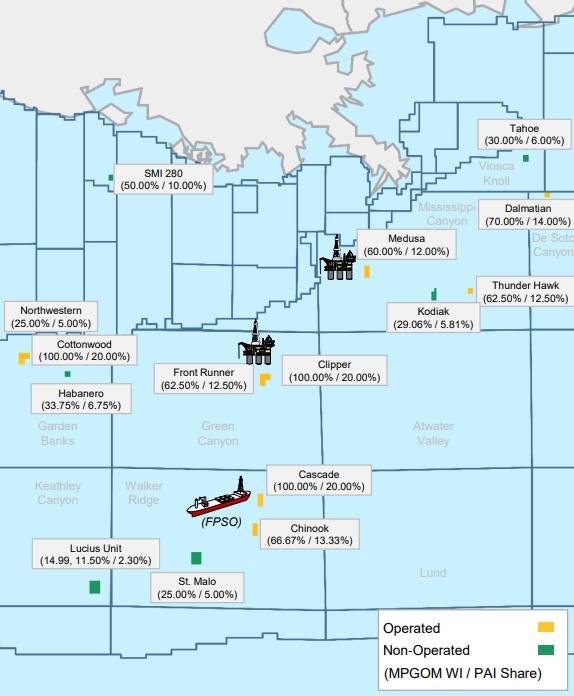

The joint venture firm, called MP Gulf of Mexico (MPGOM) owns an interest in 15 fields in the U.S. Gulf of Mexico along with an interest in St. Malo platform.

Murphy owns an 80 percent share, and Petrobras, via its PAI subsidiary, 20 percent.

The company operates eight fields, and has non-operating interest in seven.

Some of the key assets in which MGOM holds interests are St. Malo, Lucius, Cascade/Chinook, and Dalmatian offshore fields.

Petrobras has said that prospective buyers must demonstrate interest in entering the process by October 25th.

Interested oil and gas companies must have an equity market capitalization or net worth of at least US $500 million or public credit rating not less than Ba3/BBB-.

Credit: Petrobras

Credit: Petrobras