Iberdrola has taken full control of two wind projects it has been developing off the U.S. coast with Copenhagen Infrastructure Partners (CIP), as part of a global ramp-up of its offshore business.

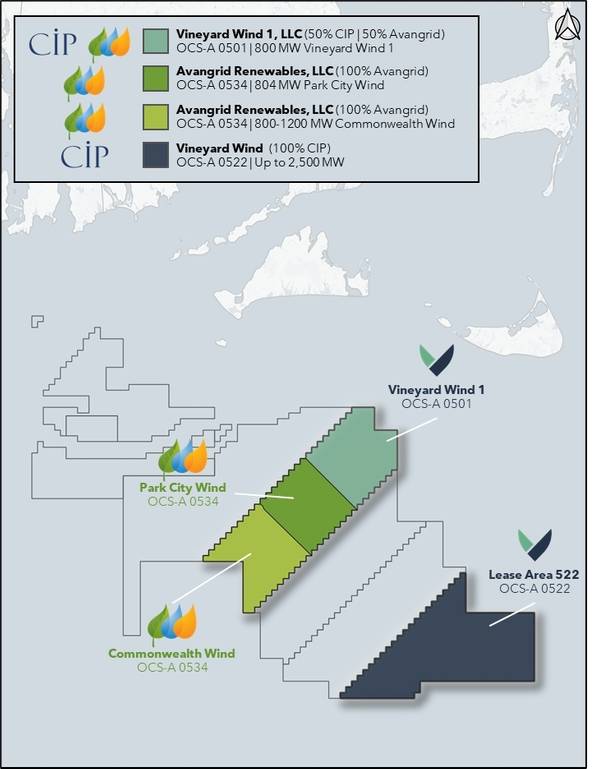

The European wind power leader's U.S. unit Avangrid will pay $167.5 million for CIP's 50% stake in two projects: an 804 megawatt (MW) site in Connecticut, and one in Massachusetts, which could have capacity of up to 1.2 gigawatts (GW).

Iberdrola is pushing hard into the burgeoning offshore wind market, which forms a key plank of global decarbonization policies.

These two projects, along with an 800 MW project off the coast of Martha's Vineyard in Massachusetts, could require an investment of around $12 billion, the company said.

Iberdrola has the option to take control of the latter, dubbed Vineyard Wind 1, once it is up and running.

Around 30% of Iberdrola's project pipeline is in offshore wind. Chief Executive Ignacio Galan said in July the company may consider spinning off that part of the business, but added no decision had been taken.

CIP, meanwhile, will take full control of a separate project in the area, which could have capacity of up to 2.5 GW.

(Reporting by Isla Binnie Editing by Mark Potter)