Mediterranean Sea-focused oil and gas company Energean has taken Final Investment Decision ("FID") on the Karish North gas development, offshore Israel.

The gas discovery was announced in April 2019. In November 2020, DeGolyer and MacNaughton issued an independent Competent Persons Report that certified 2P reserves of 32 Bcm of gas plus 34 million barrels of liquids - approximately 241 million barrels of oil equivalent in aggregate - in Karish North as at June 30, 2020.

The discovery will be commercialized via a tie-back to the Energean Power FPSO, which will be moored 5.4km away. The FPSO, being built for the main Karish discovery, is under construction in Singapore.

The Energean Power FPSO Illustration - the vessel will be used to develop Energean's gas fields offshore Israel - Credit: Energean

The Energean Power FPSO Illustration - the vessel will be used to develop Energean's gas fields offshore Israel - Credit: Energean

Energean said Thursday that the production from the first well at Karish North is expected to be up to 300 mmscf/d (approximately 3 Bcm/yr), with production start-up scheduled for the second half of 2023.

Initial capital expenditure in the project is expected to be approximately $150 million, or $0.6/boe; and Energean estimates that the project will deliver IRRs in excess of 40%.

Also, Energean said that it had on Tuesday, January 13, 2021, signed an 18-month, $700 million term loan facility agreement with J.P. Morgan AG and Morgan Stanley Senior Funding, Inc.

The company will use the proceeds to speed up the development of Karish North, enabling the capital expenditure on the project to be undertaken in advance of the first gas from the main Karish project.

After first gas from Karish North, the overall Karish project well stock will be able to produce well in excess of the full 8 Bcm/yr capacity of the FPSO, retaining operational redundancy in the well stock therefore further enhancing overall project reliability, Energean said.

The company will use part of the loan, to fund the $175 million up-front consideration for the acquisition of the minority interest in Energean Israel Limited, as announced on 30 December 2020.

Additional uses of the loan include funding around $100 million of capital expenditure required to install the second oil train and second riser on the Energean Power FPSO. This will increase the FPSO liquids production capacity to approximately 40 kbopd ( from 21 kbopd) and allow maximum gas production of 800 mmscf/d (approximately 8 Bcm/yr, from 6.5 Bcm/yr). Both the oil train and the second riser are expected to become operational during 2022.

Energean will also use a portion of the loan for the offshore Israel exploration and appraisal drilling program in early 2022, with up to five wells including an appraisal of the potential oil rim that was identified as part of the Karish development drilling campaign plus exploration of further prospective gas and liquids volumes within the Karish lease.

Athena drilling

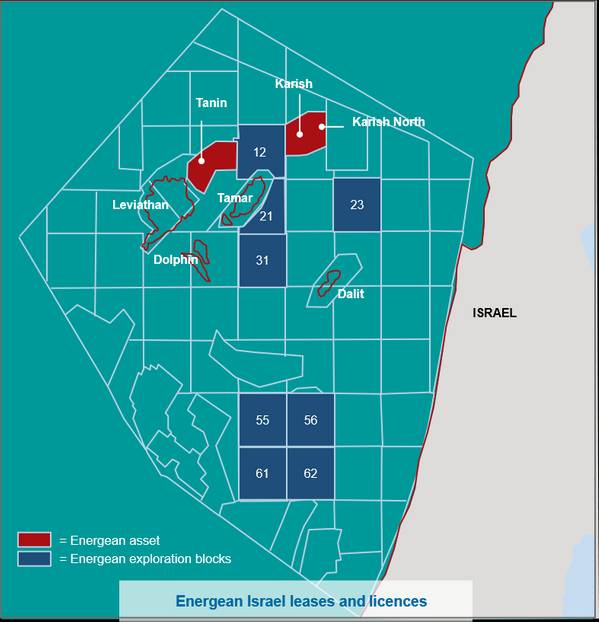

The 2022 campaign includes work in Block 12, which is located between the Karish and Tanin leases and is estimated to contain gross prospective recoverable resources in excess of 108 Bcm (3.8 Tcf).

The first well in the block is expected to target the 20 Bcm (0.7 Tcf) Athena prospect, for which the primary target (11 Bcm /0.4 Tcf) has a 70% geological chance of success.

"Success at Athena would significantly de-risk the remaining 88 Bcm (3.1 Tcf) of prospective resources in the block," Energean said, adding that any discovery in Block 12 would be prioritised over the development of Tanin due to lower capital expenditure investment and the absence of any seller royalties, unlike the Karish and Tanin leases as Block 12 was not part of the original Karish-Tanin acquisition.

Energean's additional prospects in the company's remaining exploration blocks are assessed to contain 102 Bcm (3.6 Tcf) of gross recoverable prospective resources.

Apart from securing the $700 loan, the company on Tuesday also agreed with the existing lenders of its $1.45 billion project finance facility to extend the maturity by nine months, from December 2021 to September 2022.