Israeli energy conglomerate Delek Group said on Sunday it was in talks to sell royalty rights to two small natural gas fields and was amending its proposed share offering.

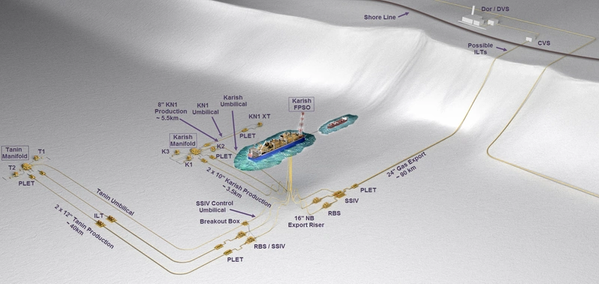

Delek said it planned to sign a 300 million shekel ($85 million) deal to sell the rights to its share of royalties from the Karish and Tanin gas fields offshore Israel in the coming days.

The group has been hard hit by the drop in energy prices and has been selling assets to raise funds and appease bondholders.

Israel's Calcalist news website reported that a deal that would reassure bondholders was close, sending Delek's shares, which are down nearly 80% since the start of the year, up 11.6% in midday trade.

It also amended a share offering it announced on Thursday for up to 2 million shares. The main difference, it said, will be in the make-up of stock options offered.

Delek said in a regulatory filing it has been holding marathon talks with bondholders, though it did not provide details. ($1 = 3.5352 shekels)

(Reporting by Ari Rabinovitch; Editing by Tova Cohen)