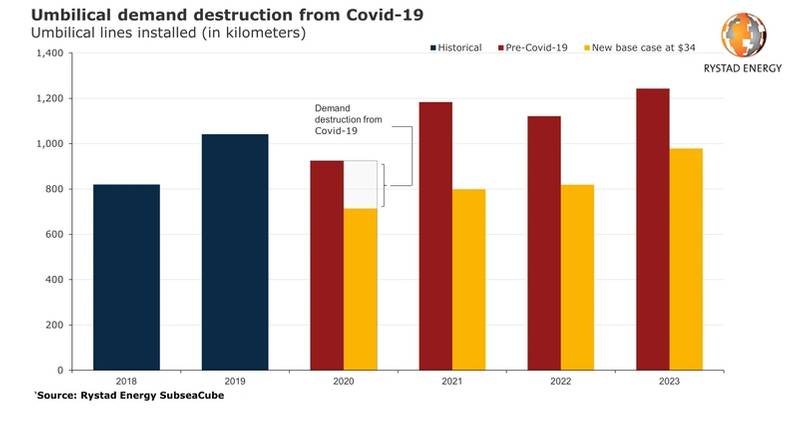

Analysts from Norway's Rystad Energy expect that the global oil and gas investment cuts will severely hit demand for subsea equipment, with demand for subsea umbilicals expected to fall by 32%.

Rystad sees just 713 kilometers (km) of lines ordered in 2020, down from 1,041 km last year.

"Umbilical demand will not match or exceed 2019 levels until after 2023, our forecasts show, despite definite cost savings in materials. To put these numbers into context, before the pandemic demand for umbilicals was due to slightly decrease this year compared to 2019, but to rebound and exceed last year’s levels from 2021 onwards," Rystad said.

Without accounting for the negative impact of a global economic downturn, we see a cost reduction of approximately 5% taking place from 2020 to 2022 within the umbilicals segment, the analysts said.

"If on the other hand, both the global recession and oil and gas industry downturn take place simultaneously, our outlook will change drastically. We then estimate a cost reduction of almost 14% over the same time frame," Rystad said.

"This will provide umbilical manufacturers short-term relief regarding their own costs as material prices fall, allowing them to maintain production volumes and recover some of their margins despite cutting their own prices. However, this short-term relief may not last long as the global economy recovers from the Covid-19 pandemic,” says Rystad Energy oilfield service analyst Henrik Fiskadal.

Not the same downturn

The materials most commonly found in the manufacturing of umbilicals are high-grade stainless steel, carbon steel armor wire, hydraulic hoses, power cables, fiber optic cables and thermoplastic resins. In addition to the materials, engineering labor is the next largest cost input involved in the manufacturing of umbilicals. Therefore, the more complicated and unique is the design, the more strenuous and costly the fabrication and installation processes, Rystad explains.

Per the Norway-based energy intelligence firm, prices for materials have remained relatively flat since 2014, whilst the service price for SURF equipment has fallen significantly.

"This illustrates the large cost savings realized by operators since 2014 and supports our belief that operators will not be able to enforce the same cost cuts from 2020 onwards, having exhausted most of the cost-cutting potential in the years following the 2014 downturn," Rystad said.

"Should we see a global recession, materials such as high-grade stainless steel may decrease significantly in price. However, when the global economy rebounds from Covid-19, material pricing could increase before the oil and gas industry is ready to accept higher prices for umbilicals," Rystad added.

"As a result, in addition to our 2020 demand forecast downgrade, we have also revised our umbilicals demand expectations for 2021-2023. In 2021, demand is expected to reach 798 km, growing to 819 km the following year and to 979 km in 2023," Rystad said.