Shares of London-listed Egdon Resources jumped on Tuesday following news that oil giant Shell farmed into Egdon's UK offshore licenses P1929 and P2304.

Under the agreement, Shell will become the operator and will acquire a 70% interest in both blocks, with Egdon retaining a 30 percent stake.

The blocks contain the Resolution and Endeavour gas discoveries respectively.

A Competent Person's Report prepared by Schlumberger Oilfield UK PLC (April 2019) reported Mean Contingent Gas Resources of 231 billion cubic feet of gas ("bcf"), with a P90 to P10 range of 100 to 389 bcf, attributable to the Resolution gas discovery (P1929).

The Resolution discovery was made by Total in 1966 when well 41/18-2 flow tested gas from the Permian aged Zechstein carbonate (limestone) reservoir. Additionally, Egdon estimates that the Endeavour gas discovery (P2304) contains Mean Contingent Resources of 18 bcf, with a P90 to P10 range of 10 to 28 bcf.

Shell to cover most of seismic costs

As consideration for the farm-in, Shell will pay 85% of the costs of the acquisition and processing of a 3D seismic survey covering both the Resolution and Endeavour gas discoveries with the carry on the acquisition costs capped at US$5 million gross, beyond which it would pay 70% of the costs.

Shell will also pay 100% of all studies and manpower costs up to a well investment decision on the licenses.

The farm-in is conditional upon approval from the Oil & Gas Authority ("OGA"); and the agreement of a mutually acceptable forward work program and timeline with the OGA.

In December 2019 Egdon announced that the OGA had granted extensions to the Licences to 31 May 2020 subject to securing a farm-in agreement by January 31, and to demonstrate by the March 31, 2020, that the licensees are on track to deliver a future program of 3D seismic data acquisition across both Licences (which, according to Egdon, is in progress).

3D seismic next

Commenting on Shell's farm-in to these licenses, Mark Abbott, Managing Director of Egdon Resources plc, said: "We are delighted to have signed a farm-in agreement with Shell in respect of these highly prospective licenses.

This transaction validates our views on the potential of these blocks and introduces a highly experienced and respected operator to progress appraisal activity on the Resolution and Endeavour gas discoveries. In difficult market conditions, Egdon has secured a substantial carry on costs to the well investment decision whilst retaining a material 30% interest in the licenses.

"Our immediate focus will be to work with Shell to agree a forward work programme and timeline for the licences with the OGA. The first part of this work program will be the acquisition of a marine 3D seismic survey to enable a decision on the contingent appraisal well. We look forward to working with Shell and benefitting from their substantial worldwide operational experience and expertise, including in the development of carbonate reservoirs of this type."

Egdon shares rose to almost 7p a share following the announcement, from 5.25p close on Monday.

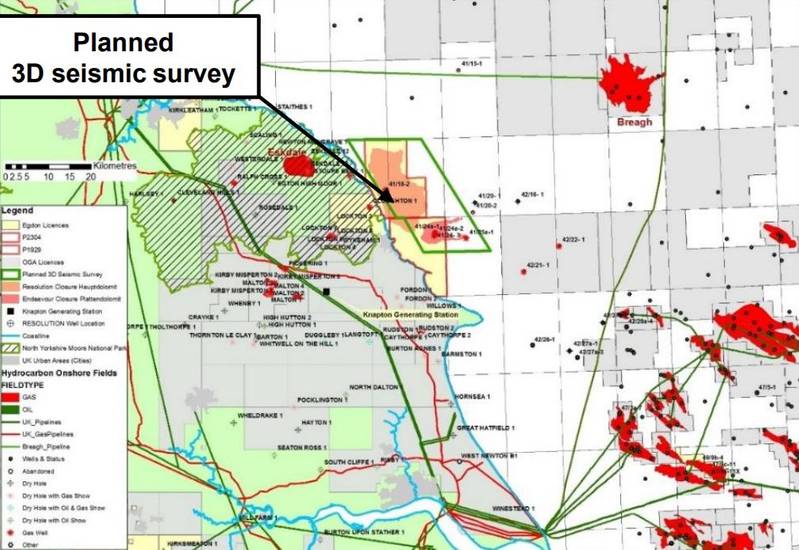

Map showing the two offshore blocks / Map by Egdon Resources

Map showing the two offshore blocks / Map by Egdon Resources