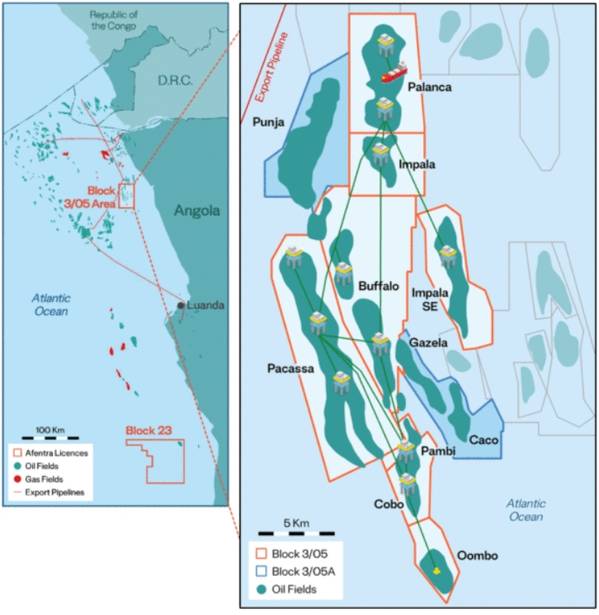

Africa-focused oil and gas company oil and gas company Afentra has agreed to buy stakes in two offshore blocks in Angola from Azule Energy Angola Production, an Angolan JV company formed in 2022 by Eni and BP.

Afentra will acquire a 12% interest in Block 3/05 and a 16% interest in Block 3/05A, offshore Angola, for a firm consideration of $48.5 million and deferred contingent payments of up to $36 million subject to oil price, production, and development conditions.

The company recently completed the acquisition of 4% interest in Block 3/05 and 4% interest in Block 3/05A offshore Angola from Croatia's INA-Industrija, and has agreements with Sonangol to acqure further stake.

"In order to ensure support for this [Azule Energy] transaction and an appropriate balance of equity interests in Block 3/05, Afentra has agreed with [Sonangol] to amend the terms of the SPA dated as at 20 April 2022 to reduce the interest being acquired by Afentra in Block 3/05 from 20% to 14%," Afentra said.

Combined with the previously announced acquisition from INA, the Azule Acquisition and the Amended Sonangol Acquisition provides Afentra with material equity in both Block 3/05 (30%) and Block 3/05A (21.33%).

"We will therefore significantly increase our exposure to the upside potential of these material production and near-term development assets with Block 3/05 benefiting from a recently extended licence term and improved fiscal terms," Afentra said.

Afentra CEO Paul McDade said:"We are delighted to have agreed terms with Azule and signed the SPA increasing Afentra's interest in the high-quality producing Block 3/05 and a material increase in our Block 3/05A interest offering access to existing discovered resources. This highly accretive transaction further demonstrates the company's commercial discipline and focus on robust cash flow, increasing our net production to ~6 kbbl/d and 2P reserves to 32 mmbbls."

Afentra expects both transactions to complete, subject to shareholder approval, in Q4 2023.

According to Afentra, production from Block 3/05 has averaged approx. 19,100 bbl/d in June 2023 and approx. 18,000 bbl/d for the first half of the year, "demonstrating the benefit of continued restoration works over Q1'23 in addition to the well intervention activities underway in Block 3/05. "

Production uptime improved quarter-on-quarter, from 77% in Q1'23 to 87% in Q2'23. Water injection has averaged approx. 38,000 bbl/d for the first half of the year, a material increase on the first half of 2022. The continued light well intervention programme will focus on acid wash and stimulation across the Oombo, Pacassa, Palanca and Bufalo fields.

In Block 3/05A, at the Gazela field, long term testing continues at approx. 1,200 bbl/d, enabling framing of potential low cost development options, Afentra said.

Future activities on Block 3/05 will consist of additional well perforations and the installation of artificial lift on a sample of production wells that Afentra is leading. A gas management workstream has started to examine a holistic solution for gas which, Afentra said, could enable a material reduction of emissions in the medium to long term.