French oil and gas major TotalEnergies has agreed to sell to Kistos Energy a 20% interest in the Greater Laggan Area fields and in the Shetland Gas Plant in the UK, as well as interests in several nearby exploration licenses.

Kistos will pay a firm consideration of $125 million, as well as two contingent payments, the first one up to $40 million depending on the gas price in 2022, and the second one in the event of development of a discovery on an exploration license.

In a separate statement, Kistos provided more details on the terms of the contingent payments.

"In the event the average day-ahead gas price at the National Balancing Point exceeds 150p/therm in 2022, up to US$40 million will be payable in January 2023. Should Benriach be developed, Kistos will pay US$0.25 per MMBtu of net 2P reserves after first gas," Kistos said.

The Greater Laggan Area comprises the Laggan, Tormore, Glenlivet, Edradour and Glendronach fields, located around 140 kilometers west of the Shetland Islands, at water depths of 300 to 600 meters.

Development of the fields was launched in 2010 and production started in 2016. The Glenlivet and Edradour fields received development approval in 2015 and subsequently came on-stream in 2017. The Glendronach field was discovered in 2018 and it is expected that the development will utilize existing infrastructure

Produced gas is routed through two dedicated flowlines which surface at the purpose-built Shetland Gas Plant (SGP), where further processing is carried out prior to export to the St. Fergus Gas Terminal in Scotland.

Production from the 20% interest sold to Kistos Energy Limited was about 8,000 barrels of oil equivalent per day in 2021.

Following completion of the transaction, TotalEnergies E&P UK Limited will hold a 40% operated interest in the Laggan, Tormore, Glenlivet, Edradour and Glendronach fields, including infield facilities and the onshore Shetland Gas Plant, alongside partners Kistos Energy Limited (20%), Ineos E&P UK Limited (20%) and RockRose UKCS15 Limited (20%).

Kistos said that it would finance the acquisition from internal resources, with the completion expected to occur in the second quarter of 2022 subject to customary regulatory and partner consents.

Andrew Austin, Executive Chairman of Kistos, said:"We are delighted to announce this transaction with TotalEnergies and look forward to working with them and the other partners in the Greater Laggan Area. The deal increases our gas production and complements Kistos' strategy in the Netherlands.

"On completion, we will have a solid foothold in both the UK and the Netherlands from which we can continue to implement our growth strategy. We expect the acquisition to increase the Company's 2P reserves by 6.2 MMboe and effectively double our end-2021 production rate to 13.5 kboe/d on a proforma basis."

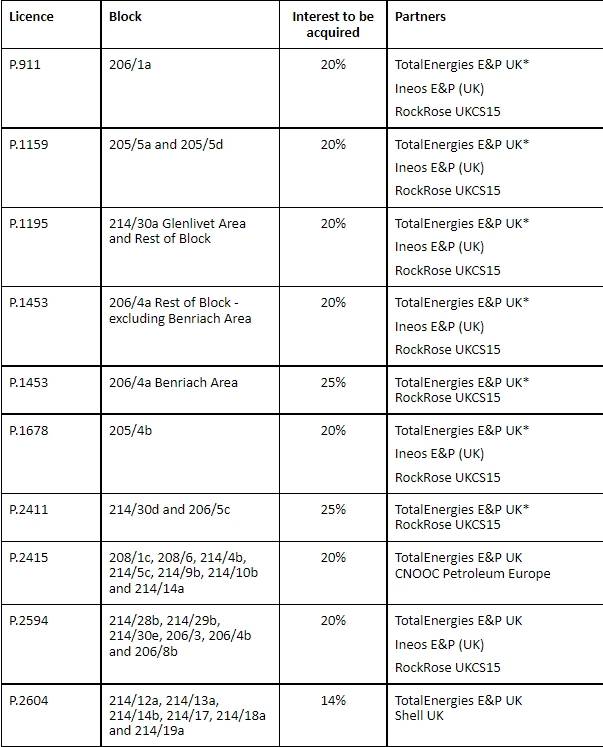

Interests to be acquired by Kistos;