Oil and gas company Eco Atlantic has agreed to acquire a stake in JHI Associates, which owns a share in the Canje block, offshore Guyana, where ExxonMobil is drilling for oil.

Eco will acquire up to a 10% interest in JHI and appoint Keith Hill, a non-executive Director of Eco, to the JHI Board.

"The transaction provides Eco with immediate exposure to a current active drilling program in the Canje Block offshore Guyana," Eco said.

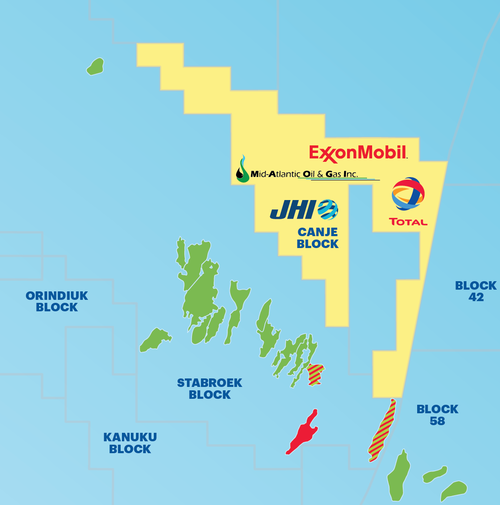

The Canje Block is operated by ExxonMobil and is held by working Interests partners Esso Exploration & Production Guyana Limited (35%), with Total E&P Guyana B.V. (35%), JHI Associates (BVI) Inc. (17.5%) and Mid-Atlantic Oil & Gas Inc. (12.5%).

Founded in 2011, JHI has been described as a Guyana pure-play deepwater exploration company.

In 2014, JHI teamed up with Guyana-based Mid-Atlantic Oil & Gas Inc. ("MOGI") which was awarded the Canje Block in 2015.

In 2016, ExxonMobil joined the Canje Block as Operator, and in 2018 TotalEnergies farmed into the Block. Five years of extensive technical and seismic data analysis led to the Canje partners identifying multiple drillable prospects and successfully applying for a multi-well drilling permit.

The 2021 multi-well exploration program on the Canje Block seeks to test the extension of the prolific hydrocarbon system which has resulted in over 9 billion barrels of oil equivalent of recoverable resources being discovered by ExxonMobil and its partners Hess and CNOOC in the adjacent Stabroek Block since 2015.

"This transaction will increase Eco Atlantic's presence in the Guyana-Suriname basin to include a three-well drilling programme, with the first two firm wells on the Canje Block drilling in 2021 and at least one on the Orinduik Block, subject to partner approval," Eco saud,

The Jabillo-1 well is currently being drilled on the Canje Block utilizing the Stena Carron drillship with results expected in July.

The Sapote-1 well is scheduled to be drilled later this year in Q3 by the Stena DrillMax in the eastern portion of the Canje Block, which Eco will also have exposure to through its now shareholding in JHI.

"Eco has subscribed for 5,000,000 new common shares in JHI at a price of US$2.0 per share, representing 6.4% of JHI's enlarged share capital "), and has been issued a warrant to subscribe for a further 9,155,471 new common shares in JHI at an exercise price of US$2.0 per share for a period of eighteen months (the "JHI Warrant"). If the JHI Warrant is exercised in full, Eco will hold an interest, ceteris paribus, of 10% in JHI on a fully diluted basis," Eco said.

As at December 31, 2020, JHI had net assets of approximately US$46.3 million and recorded a net loss of approximately US$8.28 million.

"The two-well drilling program currently underway on the Canje Block offers Eco near-term, low-risk exploration drilling catalysts with significant upside. JHI is carried on the costs for the drilling of the first well, Jabillo-1 and would also be carried for an offsetting appraisal well in the case of a discovery on Jabillo-1. The Canje Block partners have also committed to drill the Sapote-1 well later this year in Q3 2021," Eco said.

Gil Holzman, Co-Founder and Chief Executive Officer of Eco Atlantic, commented:"After a period of thorough technical analysis of the Canje block, by both our team at Eco and our strategic partners at Africa Oil Corp we are delighted to advise the market on this exciting transaction, and to be back drilling with results expected imminently."

"The carried Jabillo-1 well is underway and is expected to reach target in the coming few weeks, providing our shareholders with high impact near term catalysts.

"While we eagerly anticipate resuming drilling activity on our Orinduik block next year, pending partner approvals, and we have made sure to preserve sufficient funding for that, we are very excited that we now have two imminent Guyana wells in our portfolio as well as additional multiple prospects inventory on the Canje Block. Since 2014, Eco has strongly focused on the hydrocarbon potential offshore Guyana, and this strategic deal with JHI marks the beginning of a wider presence and potential increased future collaboration in the basin."

Credit: JHI

Credit: JHI