Equinor is preparing to sell a 20% stake in its Rosebank oil development in the British North Sea, which could fetch about $1.5 billion, two industry sources said.

The Norwegian energy giant is seeking to sell a quarter of its 80% stake in the project, the sources told Reuters.

The British government gave Equinor and partner Ithaca Energy the go-ahead on Sept. 27 to develop Rosebank, the biggest new project in the ageing basin for years.

The stake could fetch about $1.5 billion, though the final value depends on oil prices and the structure of the deal, the sources said.

Equinor declined to comment.

The Norwegian company, which operates the Rosebank project, doubled its stake in the field after it acquired Suncor Energy's UK business for $850 million this year.

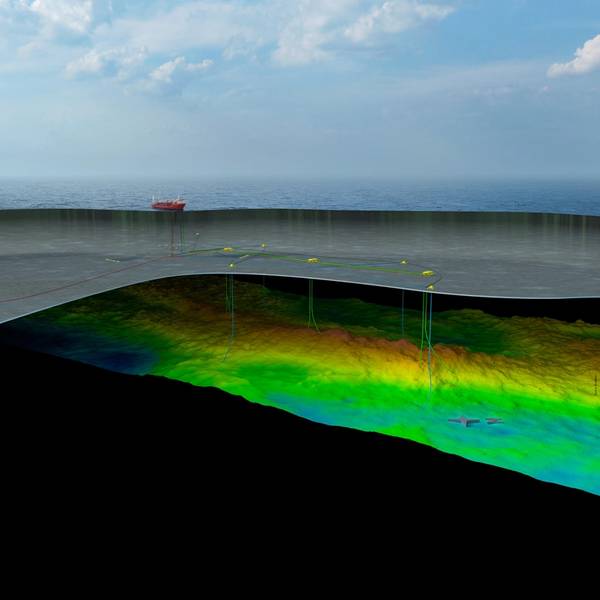

Equinor said the field, located west of the Shetland Islands, is due to begin production in 2026-27, with expected lifetime output of 300 million barrels of oil.

The company sharply reduced the field's costs, which are expected to reach $3.8 billion, by redeploying a floating production, storage and offloading vessel (FPSO) and simplifying the field's development

(Reuters - Reporting by Ron Bousso; Additional reporting by Nerijus Adomaitis; Editing by David Goodman)