Brazilian oil company Petrobras has launched the binding phase for the sale of its 20% in the company MP Gulf of Mexico, LLC. (MPGoM), which owns offshore fields in the U.S. Gulf of Mexico.

Petrobras first announced its intention to exit the joint venture in October 2021. The company at the time said that interested oil and gas companies must have an equity market capitalization or net worth of at least US $500 million or public credit rating not less than Ba3/BBB-.

"Potential buyers qualified for this phase will receive a process letter with detailed instructions on the divestment process, including guidelines for due diligence and the submission of binding proposals," Petrobras said Tuesday.

MP Gulf of Mexico is a joint venture company 80% owned by Murphy Exploration & Production Company and 20% by Petrobras.

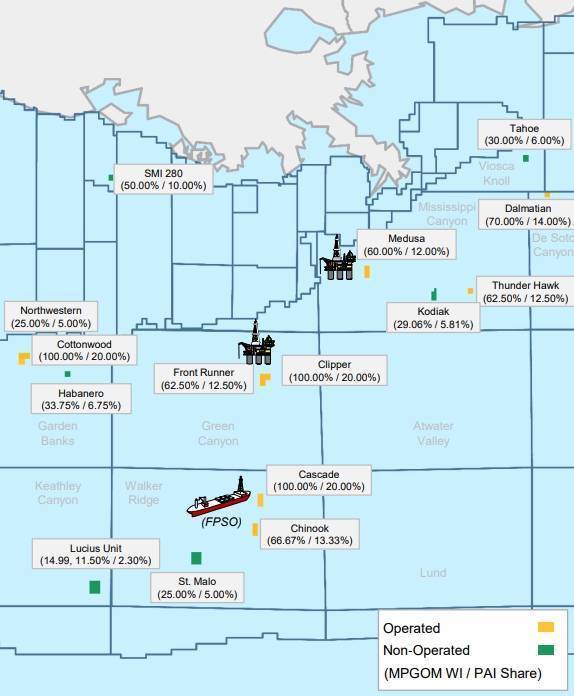

MPGoM holds participation as operator or non-operator in 14 offshore fields in the Gulf of Mexico, along with an interest in St. Malo platform. Petrobras' share of the fields' production in 2021 was 10,4 thousand bpd of oil equivalent.

Some of the key assets in which MGOM holds interests are St. Malo, Lucius, Cascade/Chinook, and Dalmatian offshore fields.

© Petrobras

© Petrobras