Teras Offshore, once a notorious ‘‘big boy’’ in Singapore’s offshore oil & gas market and owning a varied fleet of liftboats, jack-ups, and small AHTs, has recently been forced to close its doors for good and put an end to years of suffering and losses. On the 30th of December, the company officially announced it would be entering through a court-managed liquidation.

Ezion Holdings’ subsidiary company Teras Offshore was once a well-known trailblazer behind the use of multi-purpose self-propelled jack-up rigs (“Liftboats”) in the Southeast Asian energy markets. The company built their fleet during the peak of the offshore oil & gas market back in 2012, and like many other vessel owners in the industry at that time, had their fingers burnt.

The 2014 market downturn hit Teras Offshore hard, a potent combination of low day rates, contracts being postponed and, in some instances, cancellations and general uncertainty wasn’t conducive of successful business operations. The downturn showed no signs of relenting and Teras was forced further and further into the red. Then came Covid-19, the proverbial straw that broke the camel's back, and an already fragile owner was unable to take any more.

To circumvent its money woes, Teras Offshore began gradually selling off tonnage in an attempt to transition from a traditional offshore vessel owner into a ship management company. The change in business strategy was unsuccessful due to a lack of interest in further restructuring from creditors. Since Q4 2020, Teras Offshore has sold over 80% of its total Liftboat fleet generating USD 105 million in capital through sales. What has become of these assets? Who owns them now? Have they been successfully repurposed, and if so, what are they working on?

The Teras Offshore Liftboat Sales

The Teras Offshore Liftboat Sales

Figure 1: Teras Liftboat Sales Table

Figure 1: Teras Liftboat Sales TableTeras Fortress 2

On 31st December 2020, Teras Fortress 2 (450 ft blt 2015 Triyards Ho Chi Minh) was sold to Virgo Shipping for USD 22 million. VesselsValue’s market value the day before the sale was USD 22.55 million.

Now renamed Sheng Ping 001, the vessel had been contracted with China General Nuclear Power Group to install wind turbines in the CGN Huizhou wind farm near Hong Kong. On 25th July 2021, the Sheng Ping 001 reportedly capsized while installing a MySE6.25-180 turbine at the CGN Huizhou Wind Farm.

Using VesselsValue’s recency of AIS mapping tool, figure 2 shows the unit outside the CGN Huizhou wind farm.

Teras Conquest 7

On 29th January 2021, Teras Conquest 7 (320 ft blt 2015, Triyards) sold SS/DD overdue for USD 13 million, to Elite Point Pte. VesselsValue’s market value the day before the sale was USD 18.27 million.

The Teras Conquest 7 is currently on charter to Saudi Aramco working on the Manifa Oil field in the Persian Gulf. Using VesselsValue’s mapping tool, figure 3 shows the Teras Conquest 7 operating in the Manifa Oil field since 6th April 2021.

Teras Conquest 9

On 5th March 2021, Teras Conquest 9 (336 ft blt 2016 Triyards) sold USD 18.5 million, SS/DD due to SLH Ship Leasing. VesselsValue’s market value the day before the sale was USD 22.5 million.

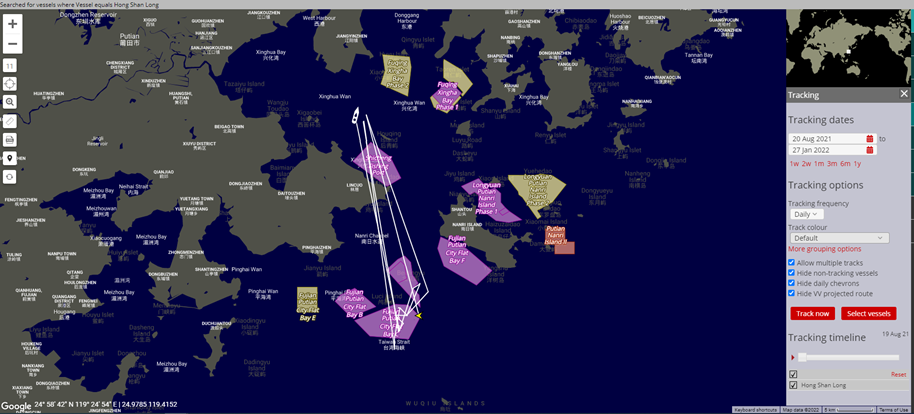

Now renamed the Hong Shan Long, the unit has been used for offshore wind turbine installation in the Fujian Putian City Flat Bay C wind farm.

Teras Conquest

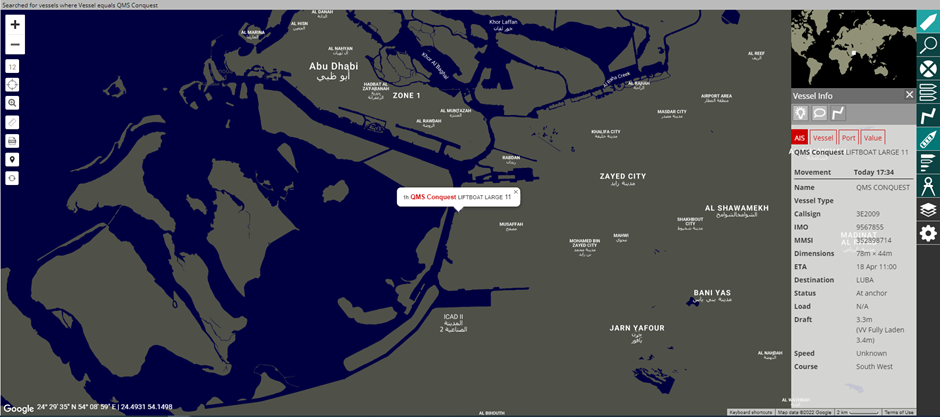

On the 26th October 2021, the Teras Conquest (320 ft blt 2012 Triyards Ho Chi Minh) sold to Zakher Marine sold USD 5 mil. VesselsValue’s market value the day before the sale was USD 12.52 million.

Renamed the QMS Conquest, the vessel is currently located in Musaffah.

Rising Phoenix

On 26th October 2021 the Rising Pheonix (320 ft blt 2010 Triyards Ho Chi Minh) sold to Zakher Marine for USD 7 million. VesselsValue’s market value day before sale was USD 11.29 million.

Renamed the QMS Al Oula, the vessel is currently located Musaffah.

Teras Conquest 5

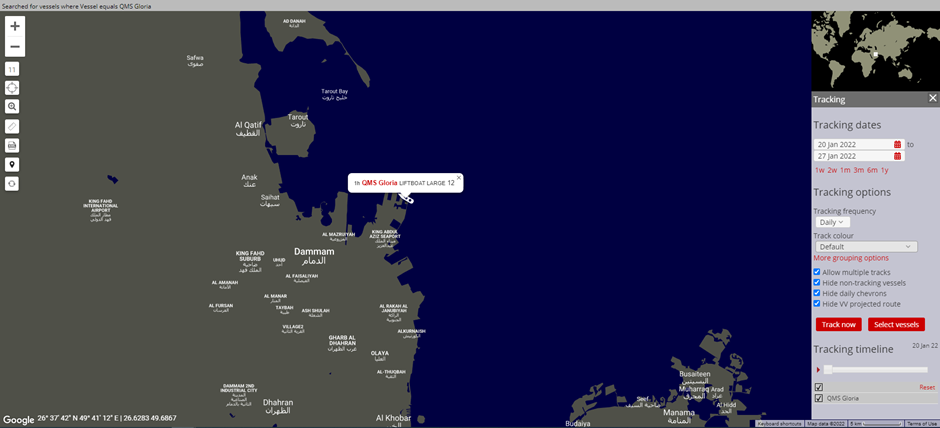

On 26th October 2021, the Teras Conquest 5 (320 ft blt 2012 Triyards Ho Chi Minh) sold to Zakher Marine for USD 8 million. VesselsValue’s market value the day before the sale was USD 13.37 million.

Renamed the QMS Gloria the vessel is currently located King Abdul Aziz Seaport.

Teras Fortress

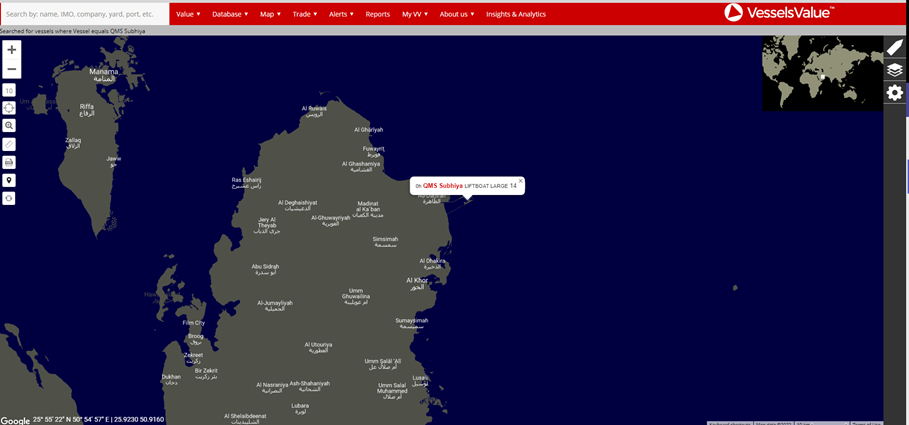

On 26th October 2021, the Teras Fortress (450 ft blt 2014 Triyards Ho Chi Minh) sold to Zakher Marine laid up DD overdue for USD 20 million. VesselsValue’s market value the day before the sale was USD 20.43 million.

Renamed the QMS Subhiya, the vessel is currently located in Ras Laffen.

Teras Conquest 8

On the 17th of December, the Teras Conquest 8 (336 ft blt 2017 Triyards Ho Chi Minh) was sold to JAD Construction Limited of WAF for an undisclosed price. VesselsValue’s market value the day before the sale was USD 20.78 million.

Renamed the Delta Conquest 8 the vessel is currently located Lagos, Nigeria. Figure 9: Ex Teras Conquest 8 AIS Lagos, WAF

Figure 9: Ex Teras Conquest 8 AIS Lagos, WAF

Teras Conquest 1

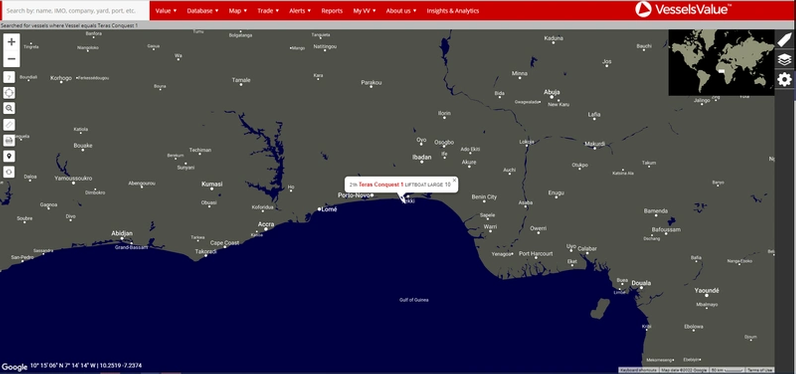

On February 7, the Teras Conquest 1 (320 ft blt 2010 Triyards Ho Chi Minh) was sold as part of a two-year BBC with a purchase obligation to April Pearl Pte, for a maximum consideration of USD 11.5 mil. VesselsValue’s market value the day before the sale was USD 11.15 million.

The new owners April Pearl Pte are a subsidiary company of Singaporean-based JUB Pacific Pte. Ltd, a liftboat operator with a focus on the renewables space, primarily in the Asian wind farm sector. The purchase of the Teras Conquest 1 will add to the companies’ services for their clients in the offshore wind industry. Figure 10: Teras Conquest 1 - AIS Location in Lagos WAF

Figure 10: Teras Conquest 1 - AIS Location in Lagos WAF

What’s left for sale and where?

Teras Offshore still has one liftboat remaining for sale. The unit has been marketed by brokers since Q4 2019, unable to attract any serious buying interest.

Teras Conquest 6 remains unsold.

According to AIS, the unit is currently active, operating near the KE Oil/Gas field, located in the Java Sea, Indonesia. In August 2021 the unit was supposed to complete its contract in Indonesia. This has likely been extended with charterers and/or renegotiated.

Teras Conquest 6 is 320 ft blt 2012 Triyards Ho Chi Minh (SS due July 2022)

The unit was previously marketed by brokers with an asking price of around USD 18 million.

Figure 11: Teras Conquest 6 AIS Location KE 30 Field Java Sea, Indonesia

Figure 11: Teras Conquest 6 AIS Location KE 30 Field Java Sea, Indonesia

Summary

Teras Offshore has been underperforming for a number of years, and consequently, the company is now deemed insolvent and unable to pay off its existing debt. Since 2020, the company has been in a state of retraction with a mix of bank-driven sales to remove assets from the fleet in order to release equity. We expected to see more of this activity throughout the course of 2022 as the company closes its doors. Unfortunately, Teras Offshore has met a similar fate as its Singapore compatriot owners, with a slow and agonizing bankruptcy.

The article, by Charlie Long, Commercial Analyst Offshore at VesselsValue, originally appeared on VesselsValue's website.