Australian oil and gas company Carnarvon Energy, which earlier this month changed its name from Carnarvon Petroleum, is set to receive the Valaris JU-107 jack-up drilling rig "within the next two weeks" and start drilling at the Buffalo-10 well-site, in the Timor Sea.

To remind, Carnarvon in September said it expected to spud the Buffalo-10 well in the Timor Sea in early November, but this date has now spilled over into December.

"Logistics teams are in place, and all appropriate support services and equipment have been contracted. The last remaining regulatory approvals are expected prior to receipt of the rig," Carnarvon Energy said.

"Carnarvon understands the Valaris JU-107 is in the final stages of its current operations with the previous operator, with rig handover expected within the next two weeks," the company said. According to Valaris' October fleet status report, the rig is on a contract with Jadestone. The fleet status report also reveals that the charter with Carnarvon is for 30 days.

Commenting on the planned drilling at the Buffalo-10 site, Carnarvon Managing Director and CEO, Mr Adrian Cook, said: “The team at Carnarvon are looking forward to receiving the rig and commencing drilling of the Buffalo10 well. We will provide updates as drilling progresses and I look forward to being able to share the Buffalo-10 well results with our shareholders early in the new year.”

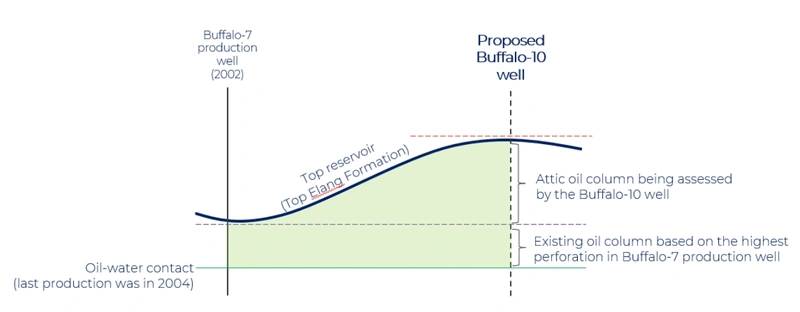

The Buffalo project involves the redevelopment of the Buffalo oil field in the Timor Sea. The field resides in only 30 meters of water with a reservoir depth between 3,200 and 3,300 meters below the sea bed. The previous field proved the existence of a very high deliverability reservoir containing high-quality light oil that is expected to sell at a premium to Brent in today’s market, Carnarvon explained.

Carnarvon, as the operator of the project, is preparing to drill a well that will penetrate the existing oil column (because the field was still producing when it was shut-in in 2004), and assess the extent of the revised mapped attic oil column.

Carnarvon’s mid-case recoverable volume estimate is 31 million barrels (gross, 2C contingent resource). With the minimum economic field size estimated to be significantly lower than the mid-case estimate, there is a strong likelihood the Buffalo-10 well will confirm an economic project, Carnarvon said.

Accordingly, Carnarvon’s drilling plans provide for the Buffalo-10 well to be retained as the first production well in the redevelopment program.

Carnarvon also said it was working with its project partner, Advance Energy Plc, on plans to compress the timeline to first production once the Buffalo-10 well confirms a commercial oil resource. These plans include engaging with industry for supply and installation of suitable equipment to produce the oil.