The offshore drilling rig market is showing remarkable signs of recovery despite having faced severe headwinds of late. Throw the “green” rig revolution and further consolidation into the mix, and the next few years could be a period of real transformation for the industry.

Rewind to July 2020, oil and gas companies were cancelling rig contracts left, right, and center. Many campaigns that were not cancelled were facing massive delays due to Covid-related travel restrictions or other logistical issues. Meanwhile, the oil price was on its knees, hitting the lowest point of just under $20 per barrel for Brent Crude, which meant demand for new drilling programs and rig award activity came to a screeching halt.

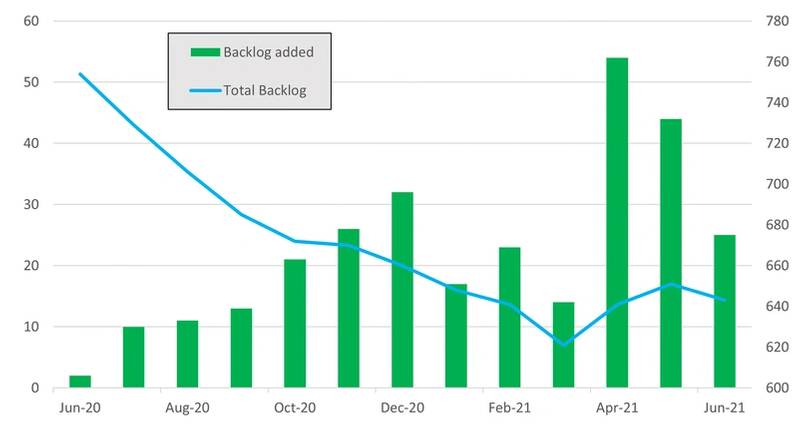

Offshore rig contract backlog was in the midst of a freefall, which according to the Esgian Rig Service, saw total backlog fall by 230 years, or 26%, between January and December 2020, while competitive utilization fell by 12% in the same period. This, of course, put further pressure on already subdued dayrates, meaning further massive losses for many rig owners, resulting in several major players filing for Chapter 11 bankruptcy.

That’s a tough year considering the market was only just coming out of one (long) downturn, only to be met by a second. However, there have been several signs of recovery in the offshore drilling rig industry of late, leading to a marked rise in optimism for the future of the industry.

Contracting activity has doubled

With thanks to the higher and more stable oil price this year, tendering and contract awards are on the rise, with rig contract backlog finally showing signs of growth after over a year of losses. Esgian Rig Service shows that since January 2021 until mid-July, there have been 192 contracts or extensions awarded, totalling over 185 years of backlog added with an estimated value of over $7 billion. In comparison, this is around 50% more than was awarded during the same period of 2020, where there were 98 awards recorded, totalling just under 93 years of backlog added. Figure 1: Rig contract backlog added & total backlog in years (June 2020 - June 2021). Source: Esgian Rig Service (previously Bassoe Rig Analytics)

Figure 1: Rig contract backlog added & total backlog in years (June 2020 - June 2021). Source: Esgian Rig Service (previously Bassoe Rig Analytics)

There has also been some upward movement in day rates as demand and competitive utilization rise faster in certain areas and segments of the market. An example of this is in the US Gulf of Mexico for 6th and 7th generation drillships with MPD capability, where supply has tightened so much that day rates have been reaching over $280,000 per day for use with MPD and $260,000 per day without it.

Though rates still have more room to rise as oversupply continues to plague the industry, it is a positive sign for drillers when comparing to the dayrate levels these rigs would have been fixed at last year (if fixed at all).

Utilization headed towards the 85% sweet spot

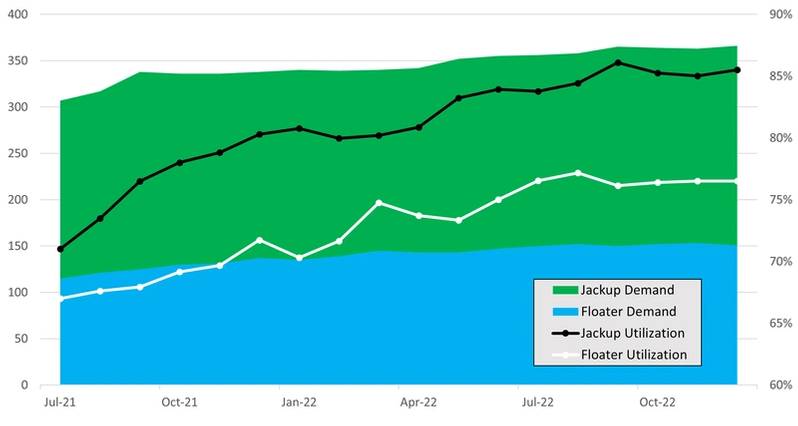

As can be seen in Figure 2, competitive jack-up utilization was sitting at 71% as of mid-July, and this figure is expected to continue rising to the 84-85% mark by Q3/Q4 2022.

Further demand recovery is expected in the jack-up segment, which will continue to be driven by National Oil Companies (NOCs) especially in areas such as the Middle East, India, Mexico and the Far East as these countries continue to focus efforts on increasing and maintaining domestic supply. On a smaller scale but still of importance, the North Sea, Southeast Asia, and West Africa will also provide jack-up demand.

Shallow-water utilization increases are expected to be more demand-driven rather than supply-driven over the next few years. Further attrition is expected in the jack-up segment over the coming years, though we believe most near-term retirements will happen within the uncompetitive fleet , which includes many units that have been cold stacked and unemployed for some time nor marketed for work. If more units from the competitive fleet were to be retired, this would be more helpful in terms of increasing competitive utilization and spurring on dayrates rises. Meanwhile, several newbuilds will finally be delivered over the next 18 months as some NOCs aim to bring in newer tonnage to replace aging assets. Figure 2: Jackup and floater demand and utilization forecast (July 2021 - December 2022). Source: Esgian Rig Service.

Figure 2: Jackup and floater demand and utilization forecast (July 2021 - December 2022). Source: Esgian Rig Service.

Slower recovery expected for floating rigs

Meanwhile, in the floating rig segment, competitive utilization is anticipated to grow from 67% (as of mid-July 2021) to around 78% by late 2022, somewhat lagging behind the jackup segment. Utilization recovery witnessed so far is partially down to increasing demand, but Esgian believes that the lower competitive supply, following a lot of cold stacking and retirements over the last year, has done a lot to kick-start those increases.

A lot of demand is coming from South America, where Petrobras is finally beginning to increase its rig count after many years of decreases, plus other independent operators are planning their own development or exploration campaigns off Brazil, too.

Meanwhile, we are also seeing increasing numbers of floaters moving into Guyana and Suriname. Outside of South America, independent operators will lead most of demand in areas such as the North Sea as well as the US Gulf of Mexico, West Africa, the Far East, and Southeast Asia.

Like the shallow-water side, Esgian believes there is further attrition planned and needed in the floating rig segment, which of course may be amplified by consolidation within the rig owner segment and potentially by the green transition.

Similarly, we expect that near term, a lot of attrition will come from the cold-stacked fleet rather than those rigs that are currently competitive, however, this will still help the market recovery longer term. There are only a handful of newbuilds planned for delivery over the next 18 months, despite there currently being 18 drillships and six semisubs under construction.

Consolidation kick-started

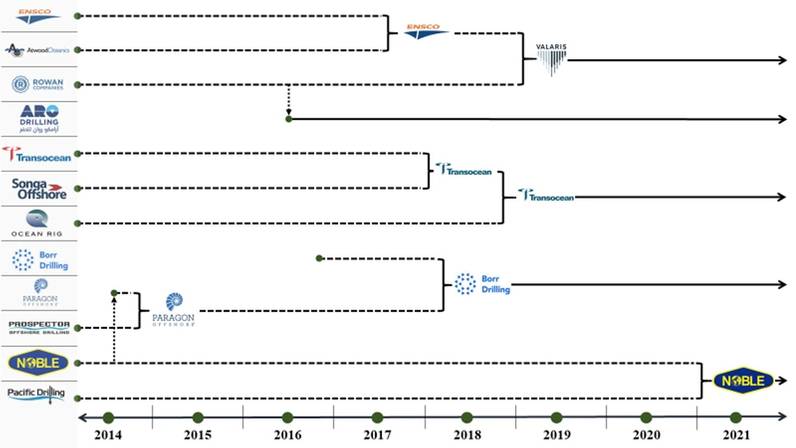

Several drilling contractors have now exited chapter 11 proceedings with fresh balance sheets, and the consolidation season appears to have kicked off with two of these companies – Pacific Drilling and Noble – merging.

Large offshore drillers have previously proven keen on consolidating during times of optimism (as depicted in the historical M&A tree shown in Figure 3). As the long-awaited recovery appears to have begun and with the first transaction out of the way, more deals are expected imminently. Figure 3: Offshore rig owner consolidation so far. Source: Esgian Rig Service

Figure 3: Offshore rig owner consolidation so far. Source: Esgian Rig Service

Since 2018, Esgian’s records show that 154 rigs have been recycled or sold for conversion outside of the drilling market, while only 62 newbuilds have been delivered and therefore, total supply is decreasing.

However, the industry continues to suffer from oversupply and fragmentation, with almost 750 rigs currently spread over 100 owners. Further amalgamations would reduce the number of owners while increasing attrition as companies often look to “right-size” their fleets post-acquisition.

Also, after years of turmoil, most offshore drillers have reduced their overall operating costs. This, combined with the likely cost synergies realized after a merger or acquisition (Noble Corporation expects to achieve annual pre-tax cost synergies of at least $30 million from the acquisition of Pacific Drilling), may allow companies to better position themselves during negotiations, especially for longer-term work at dayrates more in tune with the capital invested.

As oil prices have increased to pre-covid levels and demand has picked up, asset values also seem to have bottomed out and are increasing slightly, too.

According to Esgian Rig Service, the entire offshore drilling rig fleet is currently valued at $43.9 billion, which, although it is an almost 3% drop against July 2020’s figure of $45.2 billion, is an increase of nearly 4% on December 2020’s value of $42.4 billion. This leads Esgian to believe that the time for consolidation is now.

The “green” rig revolution

According to Esgian Rig Service, over the past year, the total fleet of jackups, semisubmersibles, and drillships generated approximately 10.7 million tonnes of CO2. So, we know that a lot of CO2 is being emitted from offshore rigs, but what’s being done about it?

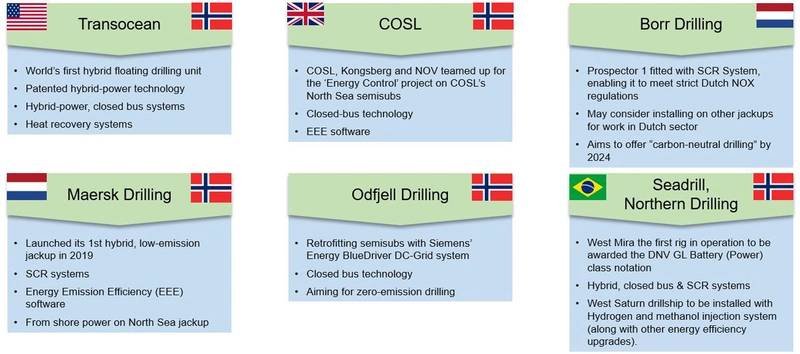

Over the past few years, there has been a growing trend of owners retrofitting their rigs with emission-reducing or fuel-saving systems in a bid to help not just their clients lower their emissions but also to help them meet their own sustainability targets as the energy transition gains pace. Figure 4: Some of the emission-reducing technology & efforts being implemented by offshore rig owners (flags indicate countries where these rigs will be put to work). Source: Esgian Rig Service.

Figure 4: Some of the emission-reducing technology & efforts being implemented by offshore rig owners (flags indicate countries where these rigs will be put to work). Source: Esgian Rig Service.

As can be seen in Figure 4, there are six rig owners/managers that have been most active so far in this area, with common system upgrades including the likes of hybrid-power, DP closed bus operations, energy emissions efficiency software, selective catalytic reductions systems.Seadrill also announced that its West Saturn drillship will be installed with a hydrogen and methanol injection system (along with other upgrades) prior to commencing a long-term campaign offshore Brazil.

Most of these systems have only been used on rigs for a short time and are in their infancy; therefore, results are still coming in, but in terms of hybrid power and closed bus solutions, targeted reductions are commonly around the 10-25% mark in terms of fuel and CO2 emissions.

As can be seen in Figure 4, the North Sea is leading the way, especially in Norway and the Netherlands, where there are either incentives or strict regulations that are driving demand for low-emission rigs. However, the US Gulf of Mexico is an area of growth due to Transocean’s roll-out of its patented hybrid power systems on several of its drillships working in the region.

Though there are currently four under-construction floaters recorded by Esgian Rig Service with such emission-reducing measures, due to high costs associated with building new rigs and with the current oversupply problem, it is likely that more delivered units will be retrofitted in the future rather than newbuild orders being placed for “green” rigs.

The energy transition: threat or opportunity?

With utilization, supply, consolidation, and dayrates seemingly headed in the right direction for rig owners, the next big challenge for the industry is now how to respond to the energy transition. Oil and gas companies are emitting tons of GHG and will experience continued pressure not only from governments and regulatory bodies to lower their emissions.

With the International Energy Agency’s (IEA) recent report arguing that investors should not fund new oil, gas, and coal projects if we should reach net-zero emissions by mid-century, the future of this industry seems uncertain. However, most operators will not divest all their assets, as hydrocarbons are expected to continue to play an important role in the energy transition and may be used to help fund alternative energy projects.

Rather, Esgian expects that these oil and gas companies will diversify their energy portfolios and look to continue drilling, but in more sustainable ways. Therefore, rather than being a problem, the energy transition could provide an opportunity for offshore drillers to gain a competitive edge if they chose to invest in asset upgrades and new technologies to help reduce harmful emissions from drilling campaigns.

Esgian Rig Service is a combination of Bassoe Rig Analytics; a database tracking global offshore drilling rig activity and demand, Bassoe Rig Values; which provides continually updated values for the entire offshore fleet, and Greenpact Rigs; an emission tracking and analyzing tool for over 750 rigs.