Ouro Preto has cut its bid for two shallow water mature oilfield clusters from Brazil's state-run oil company Petroleo Brasileiro, flagging a drop in oil prices in recent months, three sources with knowledge of the matter said.

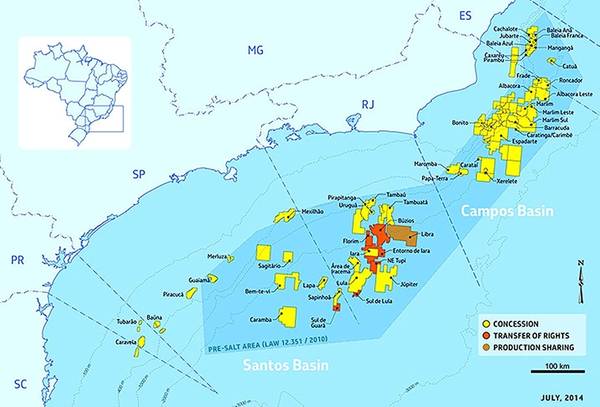

Ouro Preto, a Brazilian energy company backed by private equity giant EIG Global Energy Partners, entered exclusive talks with Petrobras in July after presenting the highest offer for the Pampo and Enchova clusters, located in the Campos basin off the coast of Rio de Janeiro state. At the time, the fields were seen fetching around $1 billion.

But the consortium cut its bid for the area, citing a fall in oil prices of around 20 percent since the end of July, on growing U.S. supply and risks of slowing global demand amid economic woes tied to the U.S.-China trade spat.

Lower oil prices could hamper efforts by Petrobras, the world's most-indebted listed oil company, to offload some other assets it intends to sell. It is seeking to raise up to $26.9 billion via asset sales and partnerships by 2023 after falling short of a goal of selling off $21 billion in the 2017-18 period.

Reuters could not verify Ouro Preto's latest bid amount, made after Petrobras last week reopened bidding for the oilfields with rules set by Brazilian audit court TCU. The move cleared the way for other investors to bid under the same contractual terms agreed with the winning consortium.

One of the three sources said Petrobras received additional bids on Dec. 7. without disclosing the names of the bidders. Despite the fall in oil prices, the additional bids were still within Petrobras's target price range for selling the cluster, the person said.

A fourth source said that Brazilian oil and gas company Petro Rio SA was considering bidding, but Reuters could not determine whether a bid was ultimately made.

Other oilfields, such as Baúna in the Santos Basin, are among the assets the company has put up for sale.

Petrobras and Ouro Preto declined to comment on the matter and EIG did not immediately respond to a request for comment.

(Additional reporting by Gram Slattery; editing by Nick Zieminski and G Crosse)