The Bureau of Ocean Energy Management announced a Proposed Notice of Sale for the third offshore oil and gas lease sale under the One Big Beautiful Bill Act. The proposed lease sale, known as Lease Sale Big Beautiful Gulf 3, or BBG3, is scheduled to take place on Aug. 12, 2026.This sale is the third of 30 Gulf of America oil and gas lease sales required by the One Big Beautiful Bill Act (Public Law No: 119-21)…

The premium currently built into the crude oil price over tensions between the United States and Iran fluctuates according to the daily headlines, but there is an underlying assumption that everything will turn out fine.Global benchmark Brent futures LCOc1 jumped 4…

President Donald Trump denounced a clean energy agreement between the United Kingdom and California Governor Gavin Newsom hours after it was signed on Monday, Politico reported.In an interview with the outlet, Trump said it was 'inappropriate' for Britain to be dealing with the Democratic governor…

The Bureau of Ocean Energy Management, today announced another major step toward expanding offshore energy development pursuant to the One Big Beautiful Bill Act. BOEM released the Final Notice of Sale for Lease Sale Big Beautiful Gulf 2 (BBG2)…

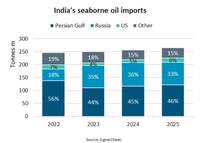

'In 2025, India’s oil imports from Russia made up 33% of the country’s total seaborne oil imports and 25% of Russia’s seaborne oil exports. A new trade agreement between the US and India could, according to US President Donald Trump, put an end to that trade…

A U.S. judge on Monday will consider a request from Danish energy company Orsted to block the Trump administration's halt on its Sunrise Wind project off the coast of New York.The preliminary injunction request is the fifth brought by an offshore wind…

Dominion Energy said on Friday the total project costs for the Coastal Virginia Offshore Wind have increased to roughly $11.5 billion from $11.2 billion.The changes in estimated costs reflect the impact of temporary suspension of work issued by the U…

GE Vernova said on Wednesday that its wind power unit might take about $250 million revenue hit this year due to installation delays at an offshore Massachusetts project and that it was expecting a drop in order backlog.The company said the…

Denmark's Prime Minister Mette Frederiksen said on Monday that her country has agreed with Germany to jointly proceed with the Bornholm Energy Island, a large offshore wind project.Frederiksen was speaking at a press conference at an energy conference…

European governments including Germany, Britain and Denmark will reinforce their plans to massively expand wind power projects on Monday, despite U.S. President Donald Trump stepping up criticism of their green energy agenda, a draft declaration due to be signed by government leaders showed…

Today the U.S. District Court for the Eastern District of Virginia granted Dominion Energy’s request for a preliminary injunction allowing construction to resume on the Coastal Virginia Offshore Wind (CVOW) project while Dominion Energy’s lawsuit challenging the agency’s action proceeds…

JERA Nex bp is acquiring EnBW’s stake in the Mona Offshore Wind Farm and has signed a lease agreement with The Crown Estate for the project, marking an important milestone for the company and for the UK’s offshore wind ambitions.This is a significant…

The underlying lawsuit challenging the U.S. Department of the Interior’s December 22, 2025 suspension order will continue to proceed.Empire Wind will now focus on safely restarting construction activities that were halted during the suspension period…

The Energy Workforce & Technology Council has released its December 2025 jobs report, marking the end of a year of workforce adjustment, market uncertainty, and federal labor data disruptions.Energy services employment totaled 629,372 jobs in December…

Responding to the UK Government’s announcement on the results of the Contracts for Difference Allocation Round 7, Neil Gordon, chief executive of Global Underwater Hub (GUH), said:“The award of a record 8.4GW of offshore wind capacity through AR7 is a positive step for the UK…